Videos added by MANSARD

82 videos found

In this insightful video, we delve into the rapid fluctuations in lending rates and their profound effects on commercial property values. With lending rates on the move, we explore how banks are assessing deals, pricing risks, and determining valuations in today's market.

Join us as we walk you through a powerful spreadsheet tool utilized by our company to create valuations using both the income approach and sales comparison approach. Discover the methodology appraisers employ to develop the cap rate, allowing us to assess the market's cap rate adjustments in response to changing interest rates and bank practices.

We start by examining recent developments in the lending market, with Jay Powell's testimony before Congress and the recent 25 basis points increase in the Fed funds rate, taking it to 5.5%. The projection is towards a 5.75% rate, which directly impacts commercial property pricing and loan evaluations.

During a conversation with a lender, we analyze a 40,000 square foot industrial building generating $15 per square foot base rent ($600,000 annually) with capital reserves included. By considering a 25-year amortization and building in the lender's risk margin on the borrowed funds, we witness how the interest rate impacts the cap rate and overall valuation.

As banks have grown cautious due to the rate run and increasing market risks, they are marking up interest rates by up to 3%, influencing cap rates even further. We explore how this directly affects cash-on-cash return requirements for investors and how valuations are adjusted accordingly.

To better comprehend the impact of these changes on property values and market expectations, we compare valuations from different interest rate environments, highlighting the emergence of a bid-ask gap.

Finally, we emphasize the importance of being proactive in determining property valuations and positioning in this ever-changing market. If you want expert guidance in evaluating your property's worth and finding the right buyer at the right price, visit our website at mansardcre.com and request a consultation with our experienced team. Subscribe to our channel for more market insights and updates on commercial real estate. Stay informed and stay ahead in today's dynamic real estate landscape.

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter: https://twitter.com/mansardcre

MANSARD | Date Uploaded: August 07, 2023

| Date Created: August 03, 2023| Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research, Educational Programs

| Industrial, Multifamily, Office, Retail, ALL

| ALL

Have you ever wondered how commercial real estate brokers determine the value of commercial properties? In this informative video, Jeremy Cyrier, CCIM shares insights into the valuation process and what you should know when working with a broker.

Whether you're a seller or a buyer, understanding the various types of values involved, such as the seller's value, buyer's value, and market value, is crucial. Jeremy explains how brokers consider appraisals, lender's values, tax assessor's values, and other factors to arrive at a comprehensive valuation. He emphasizes the importance of selecting a broker who demonstrates a methodology and proven process to determine market value accurately. By following this approach, you can make informed decisions regarding pricing and marketing your property.

If you're interested in getting an evaluation for your commercial real estate, visit mansardce.com and request a consultation with the expert at Mansard. Subscribe to the channel for more valuable videos on commercial real estate, market updates, and insights.

Values Mentioned in Video:

Seller’s Value

Buyer’s Value

Market Value

Appraiser’s Value

Lender’s Value

Assessor’s Value

Broker’s Value

Links Mentioned in Video:

Why buyers underprice commercial real estate:

• Why buyers underprice commercial real...

How to Choose the Right Commercial Property Sales Comps:

• How to Choose the Right Commercial Pr...

How to Calculate Commercial Real Estate Value (My Cap Rate Trick):

• How to Calculate Commercial Real Esta...

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter: https://twitter.com/mansardcre

MANSARD | Date Uploaded: August 07, 2023

| Date Created: July 18, 2023| Commercial Properties for Sale, Brokerage, Educational Programs, Appraisal

| Industrial, Multifamily, Office, Retail, ALL

| ALL

In this video, Jeremy Cyrier, CCIM President and Commercial Real Estate expert dives into the potential impact of increasing interest rates on commercial real estate values. With recent news of Jerome Powell's plans to raise interest rates again in 2023, many are curious about the consequences for the market.

Starting with the inflation rate, which currently stands at 4% year over year, it has fallen but not enough to satisfy the Federal Reserve. Instead of stabilizing rates, they are signaling that we can expect further increases throughout the year.

So how does this affect commercial real estate? Well, as lending rates rise, the cost of borrowing capital for investing in commercial properties becomes more expensive. Consequently, investors or buyers have to pay less for properties to achieve desired returns that align with risk-adjusted financial goals.

A recent senior loan officer survey conducted in April 2023 highlighted that banks are tightening credit for commercial real estate lending. They are lowering loan-to-value requirements and increasing spreads over the cost of borrowed funds. This means that borrowers will face more stringent criteria and higher interest rates.

For example, in a normal market environment, a bank in the Boston area might borrow money from the Federal Home Loan Bank at 4.2% and add a markup of 1.6% to 2.2% to arrive at a competitive lending rate. However, due to the changing lending landscape, banks now request lower loan-to-value ratios and are quoting interest rates in the range of 8% to 10%.

Consequently, illiquidity is expected to enter the market, leading to a slowdown in transaction velocity throughout 2023. Obtaining borrowed funds will become more challenging, causing sales to take longer and introducing lag and drag to the market. However, buyers with access to cash and capital will have opportunities to capitalize on these market conditions.

If you are planning to sell your commercial property, it is crucial to include current lending assumptions in your underwriting. The lending environment is evolving rapidly, and relying on past lending assumptions can lead to unrealistic expectations. Additionally, it's important to find buyers with preexisting banking relationships, as many banks now prioritize borrowers they have already worked with.

Stay informed about the rapidly changing landscape of the commercial real estate market. If you have any questions or would like to request a consultation, visit our website at mansardcre.com. Simply click on the "Request Consultation" button in the top right corner to contact us. Our experts will be happy to address your concerns and provide the information you need to make informed commercial real estate decisions.

Video Links:

https://www.federalreserve.gov/data/s...

https://www.fhlbboston.com/fhlbank-bo...

https://www.federalreserve.gov/newsev...

https://www.nytimes.com/2023/06/21/bu...

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter: https://twitter.com/mansardcre

MANSARD | Date Uploaded: July 14, 2023

| Date Created: July 10, 2023| Commercial Properties for Sale, Economics/Market Reports/Research, Educational Programs, Lending / Finance

| Industrial, Multifamily, Office, Retail, ALL

| MASSACHUSETTS

In this informative video, Jeremy Cyrier from MANSARD sits down with 1031 exchange expert Patty Flowers to discuss the ins and outs of using 1031 exchanges for retirement planning. Jeremy introduces Patty as his go-to expert for all things related to 1031 exchanges and explains that they wanted to address a common question they receive: how to retire from real estate investments without paying hefty taxes.

Patty explains that a 1031 exchange is an estate planning tool that allows investors to defer up to 100% of taxes when selling a property. The goal is to reinvest the proceeds into equal or greater value properties. She discusses various scenarios where investors might buy single tenant triple net lease properties for income and also consider purchasing a primary residence for retirement using a 1031 exchange.

The conversation delves into the specific requirements and regulations surrounding the use of a 1031 exchange for setting up a primary residence. Patty explains that a residential rental property can qualify as a like-kind exchange, but it must be rented for at least two calendar years. She details the IRS regulations regarding personal use and rental periods during the first two years of ownership.

Jeremy and Patty discuss the transition from investment use to personal use, commonly known as converting the property. They clarify that no taxable event occurs when converting the property into a primary residence. However, they note that reporting changes are required, such as the cessation of rental income and depreciation on tax returns.

Furthermore, Patty highlights the proration of the primary residence exemption when selling a property that was previously a 1031 exchange. The IRS regulations dictate that the exclusion will be prorated based on the total period of ownership and the time spent renting versus personal use.

The video also explores the option of reinvesting the property back into the rental market after living in it as a primary residence, allowing for potential future exchanges. Jeremy and Patty touch on the importance of estate planning and the stepped-up basis benefit, which can eliminate capital gains tax liability for heirs when the property is passed down upon the owner's death.

Timestamps:

00:05 - Introduction

01:06 - Exploring the 1031 exchange for retirement planning

02:45 - Requirements for 1031 exchanges and mixing property types

04:42 - Regulations for using a 1031 exchange to set up a primary residence

06:35 - Converting the property to a primary residence and tax implications

08:26 - Proration of the primary residence exemption and taxable gains

09:47 - Using a 1031 exchange to save on taxes and the stepped-up basis benefit

11:59 - Exploring the estate planning benefits of a 1031 exchange

13:37 - Conclusion and contact information

Patricia A. Flowers, CES®

Vice President

Toll-Free: (877) 781-1031

Cell: (617) 899-4718

Direct: (617) 423-1031

Toll-Free Fax: (888) 310-1868

Email: patricia.flowers@ipx1031.com

https://www.ipx1031.com/locations/nam...

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter: https://twitter.com/mansardcre

MANSARD | Date Uploaded: July 14, 2023

| Date Created: July 10, 2023| Commercial Properties for Sale, Brokerage, Educational Programs

| ALL

| MASSACHUSETTS

In this video, Jeremy Cyrier from MANSARD discusses the challenges and recommendations when dealing with commercial real estate decisions within a family. Drawing from his own experiences, Jeremy provides valuable insights and practical advice for families looking to sell or buy commercial real estate properties. He emphasizes the importance of being well-organized and having clear communication among family members to ensure a smooth decision-making process. Jeremy also addresses the emotional aspects associated with selling a property that holds sentimental value, highlighting the need for family members to prepare for the range of emotions that may arise during the transaction. Additionally, he stresses the significance of having a skilled attorney well-versed in estate, probate, and trust matters to ensure all necessary paperwork is in order before entering the market. With over a thousand commercial real estate transactions under his belt, Jeremy's expertise shines through as he provides valuable tips for families navigating this complex process.

To learn more about MANSARD and how they can assist with your family's commercial real estate decisions, visit our website at mansardcre.com and click on the "Request a consultation" button in the top right corner of the page. Subscribe to our channel for more informative videos and stay updated on the commercial real estate industry, specifically in the greater Boston area.

Contact our office directly at 617-674-2043 for immediate assistance. Don't miss out on the opportunity to make informed decisions and ensure a successful transaction for your family. Like this video and share it with others who may benefit from Jeremy's expertise.

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn:

https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook:

https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter:

https://twitter.com/mansardcre

MANSARD | Date Uploaded: July 14, 2023

| Date Created: June 27, 2023| Commercial Properties for Sale, Brokerage, Educational Programs

| Industrial, Multifamily, Office, Retail, ALL

| MASSACHUSETTS

In this video, Jeremy Cyrier from MANSARD, discusses the state of the commercial real estate market. Jeremy shares his experience of exploring the most viewed videos about commercial real estate on YouTube, only to find a common theme of doom and gloom. While there are challenges in the market, such as interest rate hikes and shifting work paradigms, it doesn't mean the entire commercial real estate market is unhealthy. Jeremy emphasizes the importance of focusing on specific asset classes, markets, and cycles to gauge the market's health accurately.

Jeremy highlights that the market exists within our own perceptions and encourages viewers to be mindful of the content they consume. He reminds us that the value of a property is subject to perception and that the market's diversity offers opportunities for buyers and sellers alike. If you're feeling uncertain about the market, MANSARD is here to help. Visit our website for a consultation and expert guidance on navigating your commercial real estate portfolio.

Subscribe to MANSARD's channel for insightful market discussions and updates, with a focus on the greater Boston area. If you have questions or need assistance, our team is ready to provide answers and direct you to the right resources.

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn:

https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook:

https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter:

https://twitter.com/mansardcre

MANSARD | Date Uploaded: July 14, 2023

| Date Created: June 27, 2023| Brokerage, Economics/Market Reports/Research

| ALL

| MASSACHUSETTS

Have you been wondering about the market? We're going to cover Rockingham, Essex, and Middlesex counties for retail, office, industrial, and flex properties. The big theme of this update is about a 20-minute video, that is going to be what I call the pause, and I will explain that to you as we get into the data. The key thing to keep an eye on is the average price per square foot for the trades that have happened year to date, in contrast to prior years....

MANSARD | Date Uploaded: April 12, 2023

| Date Created: April 20, 2023| Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial, Multifamily, Office, Retail, ALL

| MASSACHUSETTS

What are the six signs to watch for when it's time to list commercial property?

"I have negative cash flow and I need to sell."

"I sold, closed, or moved my business and need to my commercial real estate for sale."

"I'm tired of managing the property."

"I've grown the property to what I think to be its full potential and I'm ready to list my commercial property."

"Investors are pressing me for their returns."

"I want to list commercial property and leaseback to generate cash to grow my business."

Process:

1. Discovery

2. Evaluation

3. Exposure

4. Closing

A lot of times when you're thinking of listing commercial property, it's easy to want to try to time the market and figure out is this the best time to go to market? And frankly, I've been doing this for over 20 years, and involved in over a thousand transactions, and I'll tell you that it's only during market peaks that we see property owners who want to list commercial property coming to market and telling us they're selling because they've grown the property to the full potential. It's not going to increase in value anymore from their perspective, and that's the number one reason why they're selling. So that's predominantly one of the reasons why you would list commercial property, but unfortunately, peak cycles happen only once every about 10 years, so there have to be five other signs that you would identify for when it's the right time to sell.

Thanks for watching the video. If you like it, you can hit that notification bell, give us a thumbs up and subscribe. We look forward to seeing you in the next video. Thanks.

~~~~

Subscribe to MANSARD’s YouTube Channel: / @commercialreales...

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn:

https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook:

https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter:

https://twitter.com/mansardcre

MANSARD | Date Uploaded: March 13, 2023

| Date Created: March 13, 2023| Commercial Properties for Sale, Brokerage

| Industrial, Office, Retail, ALL

| MASSACHUSETTS

What are the four most important categories for you to consider when you're preparing to evaluate an investment property, particularly if you're getting ready to sell your property and you want to understand what the value is in today's market? In this video Jeremy Cyrier, President & founder will go over crucial information related to these 4 Keys to evaluating an investment property.

Thanks for watching the video. If you like it, you can hit that notification bell, give us a thumbs up and subscribe. We look forward to seeing you in the next video. Thanks.

~~~~

Subscribe to MANSARD’s YouTube Channel: https://www.youtube.com/channel/UCGn7GBJqbP6YNqJmw0Lqbiw?sub_confirmation=1

~~~~

6 Reasons Why People Are Selling in Today's Market: https://masscommercialproperties.com/six-signs-its-time-to-sell

~~~~

Connect with MANSARD on LinkedIn:

https://www.linkedin.com/company/mansard-commercial-properties/

~~~~

Follow MANSARD on Facebook:

https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram: https://www.instagram.com/mansardcommercialproperties/

~~~~

Follow MANSARD on Twitter:

https://twitter.com/mansardcre

MANSARD | Date Uploaded: March 06, 2023

| Date Created: March 06, 2023| Commercial Properties for Sale, Brokerage

| Industrial, Medical, Multifamily, Retail, ALL

| MASSACHUSETTS

If you've recently sold your company and the buyer of your business has come back to you and asked you about buying your property, then this video is for you. In this video, Jeremy Cyrier provides insight on what to consider when your tenant wants to buy your property.

If you're interested in learning more about how to do evaluation when you're in this specific situation, feel free to reach out to us. You can request a consultation on our website, at mansardcre.com, or you can call our office and we'll be happy to have a conversation with you to talk to you about how we help a business owner such as yourself, figure out how to best approach a situation where you have a tenant who owns your prior company that wants to buy your real estate.

Thanks for watching the video. If you like it, you can hit that notification bell, give us a thumbs up and subscribe. We look forward to seeing you in the next video. Thanks.

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

6 Reasons Why People Are Selling in Today's Market:

https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn:

https://www.linkedin.com/company/mans...

~~~~

Follow MANSARD on Facebook:

https://www.facebook.com/mansardcre/

~~~~

Follow MANSARD on Instagram:

https://www.instagram.com/mansardcomm...

~~~~

Follow MANSARD on Twitter:

https://twitter.com/mansardcre

MANSARD | Date Uploaded: February 27, 2023

| Date Created: February 15, 2023| Commercial Properties for Lease, Commercial Properties for Sale

| Industrial, Land, Medical, Multifamily, Office, Retail, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| MASSACHUSETTS

292 Lowell Street (Including 39 Winter Street) is a multi-tenant, dual building 6,651 SF auto service retail property in Lawrence, MA. The property consists of 8 drive-in bays, an office and customer waiting area with two restrooms, and an additional 900 SF of mezzanine storage. 292 Lowell Street is fully sprinklered and features (4) 10' x 10' Doors and (2) 12' x 10' doors. 39 Winter St has (2) 10' x 10' Doors and is not sprinklered. The property features 2005 updates, including new garage doors, an entrance door, windows, a rubber roof, natural gas heating system, ceiling lighting, and an office with 1 ADA accessible restroom, along with gas, water, and sewer connections to the

Want to learn more? https://buff.ly/3PIcnyq

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: February 27, 2023

| Date Created: March 14, 2023| Commercial Properties for Sale

| Industrial, Retail, Automotive

| MASSACHUSETTS

Everyone wants to sell a commercial property when the accepted offer equals the closing price.

Renegotiations are frustrating, time-consuming, and expensive and can damage your profits and reputation if the sale of your commercial property fails to close. Most sellers want to avoid investing to pull together the 5 best things to do before selling their commercial property.

Who wants to invest money into selling a commercial property when you are curious if a buyer will pay you the right price?

Unfortunately, what's more expensive and disappointing is when the excitement of finding a buyer and forming an agreement results in a renegotiation. Buyers will often agree to a price to put the property under agreement, followed by extensive and expensive due diligence. The results often change the buyer's mind on the offer price and lead to frustrating renegotiations.

** The 5 Best Things To Do Before Selling Your Commercial Property ** Property Condition Assessment

Environmental Reports

Title Survey

Rent Roll

Prior 3 years of Operating Expenses

When you complete these items before offering your commercial property for sale, you give the buyer a clearer picture of the physical and financial health of the property.

You narrow the bid-ask gap because the buyer's risk is mitigated with this valuable information. Moreover, you build trust with the buyer, resulting in higher offer prices and a smoother sale.

Are you looking to sell your commercial real estate?

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: February 27, 2023

| Date Created: February 07, 2023| Commercial Properties for Sale, Brokerage, Appraisal

| Industrial, Multifamily, Office, Retail, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, ALL, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| MASSACHUSETTS

In this video Jeremy Cyrier from MANSARD will be giving an update on the year-end sales numbers for 2022 for office, retail, flex and industrial sales in the greater Boston and southern NH markets.

MANSARD has pulled together all of the trades that happened in Rockingham, Essex, and Middlesex Counties, valued between $1M and $100M in 2022. In this video Jeremy is going to show you some data, charts, and market cycle trend information. We hope you enjoy it, and if you do, please give us a thumbs up, subscribe to our channel.

"This is our year-end review of 2022 looking at the market for Rockingham, Essex and Middlesex Counties. So we're really focused on greater Boston sales trends, commercial sales trends. This is identifying the office, industrial and retail markets valued between $1M and $100M. So when we look at the market, what we like to do is look at it in a perspective historically, and we track data going back to 2006, so we can see the market cycle year-by-year for sales volume by buildings traded. And what this gives us a sense of is the relative stage of the market and how active it is. And as you can see here, we had a peak year in 2021 with 829 sales really dwarfing all of the prior years going back to 2006, even 2022 ended up as a very strong year with a long-term average at 455 sales per year. So what we saw in 2022 was about 707 trades, which is still quite strong. Looking at our year-over-year effective change in year-to-date sales, we can see the slowdown in the market, namely the transition here that looks somewhat like this downward trend in the 2007 Great Recession into 2008, just the scale of the velocity of slowdown. Now, not as deep an effective change. As you can see, we ended 2022 with a 21% year-over-year change. And that is a strong change in velocity, but not anywhere as grave or dire as we saw back in 2007, 2008, when transaction of volume plummeted severely. The 10 Year Treasury been very popular in the news. If you're reading financial news, you're seeing the constant references to the yield of the 10 Year Treasury. Looking at it historically, you can see we did bottom out in 2020 with an average yield that was phenomenally low, just around that 1% mark. We ended 2022 with a 10 Year Treasury at about 3.5%. Because we started the year at the lower end of the range, our average yield for the year came in on the chart just below 3%. But what's interesting is looking at the annual percentage change, you can see here that the dramatic increase in the 10 Year Treasury by the Federal Reserve shows just this very sharp up into the right trajectory of change. And it does make me wonder how much further this is really going to go. There's chatter about a rate increase here in early 2023, but wondering, and I'm thinking maybe this is going to start to taper. And if you look at this percentage change, you'll see that the interest rate policy going back to 1990, an annual percentage change, does tend to fluctuate. We're accustomed to changes in the last 10 years, but it's interesting here that we've seen such rapid change. Will we see this level off? Will we see it start to come down? When will it start to come down? We're not really sure. Looking at sales volume in relation to the prior years, again, that annual transaction velocity from 2006 to 2022, 455 deals per year of trading hands on average. It's about $2.7B annually that we see in the market. Last year, 2022, we saw 707 transactions and $4.7B in volume. Now granted, there's some appreciation in that number, but looking at the sales volume in the market, we can see here that we are still very busy. The question is, when did the market start to decelerate? And when we look at 2021 in relation to 2022 and we start plotting these Fed rate hikes in 2022, we see here that the market really didn't start to respond until about October, November, and December where we saw a tapering of sales happening. And so it was really the shock of those May, June and July rates hitting the market that we started to see the deals closing in October, November, December, reflecting the changing environment. So we're expecting to see that continue into 2023. I would be surprised if we had another 707 unit sale this year. My expectation is we're going to trend down more toward the long-term average this year in volume..."

Are you looking to sell your commercial real estate?

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: February 27, 2023

| Date Created: February 02, 2023| Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Industrial, Office, Retail

| MASSACHUSETTS

Welcome to our How's The Market? update here at MANSARD. One of the things that we know here at the company is that finding the right commercial real estate buyer who performs on a deal can be hard to do, and bad deals made with wrong buyers lead to failed sales. It's embarrassing, and you can end up with a discounted sale price, which is a terrible thing. So, we developed a 42-point process to connect commercial real estate owners with high performing buyers who pay the right price so that they experience financially meaningful life events with their investments in real estate.

So, when you sell to the right buyer, you experience a financially meaningful life event with your real estate investment and that's what this is all about. That's why we develop and share these market insights in this data because if you don't understand what's happening in the market in real time, it's going to be hard to make the right real estate decision. So, we've taken data from Middlesex and Rockingham Counties. These are representative to the Boston suburbs and how we track the sale of retail, office, and industrial properties from 1 to 100 million on an annual basis. The reason why we do this is because we want to understand how making the right real estate decision fits into the overall timing of the market.

We have taken data from Middlesex and Rockingham Counties. These are representative to the Boston suburbs and we track the sale of retail office and industrial properties from one to 100 million on an annual basis. The reason why we do this is because we wanna understand how making the right real estate decision fits into the overall timing of the market.

If you want to be kept in the loop on what's going on, and if you are interested in learning more about us, you can visit our website at www.mansardce.com. We're here to help and if you have any questions, feel free to reach out. We look forward to seeing you on our next market update!

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: December 02, 2022

| Date Created: December 02, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial, Office, Retail

| MASSACHUSETTS

Welcome to our, How's The Market? update here at MANSARD. One of the things that we know here at the company is that finding the right commercial real estate buyer who performs on a deal can be hard to do, and bad deals made with wrong buyers lead to failed sales. It's embarrassing, and you can end up with a discounted sale price, which is a terrible thing. So, we developed a 42-point process to connect commercial real estate owners with high performing buyers who pay the right price so that they experience financially meaningful life events with their investments in real estate.

So, when you sell to the right buyer, you experience a financially meaningful life event with your real estate investment and that's what this is all about. That's why we develop and share these market insights in this data because if you don't understand what's happening in the market in real time, it's going to be hard to make the right real estate decision. So, we've taken data from Middlesex and Rockingham Counties. These are representative to the Boston suburbs and how we track the sale of retail, office, and industrial properties from 1 to 100 million on an annual basis. The reason why we do this is because we want to understand how making the right real estate decision fits into the overall timing of the market.

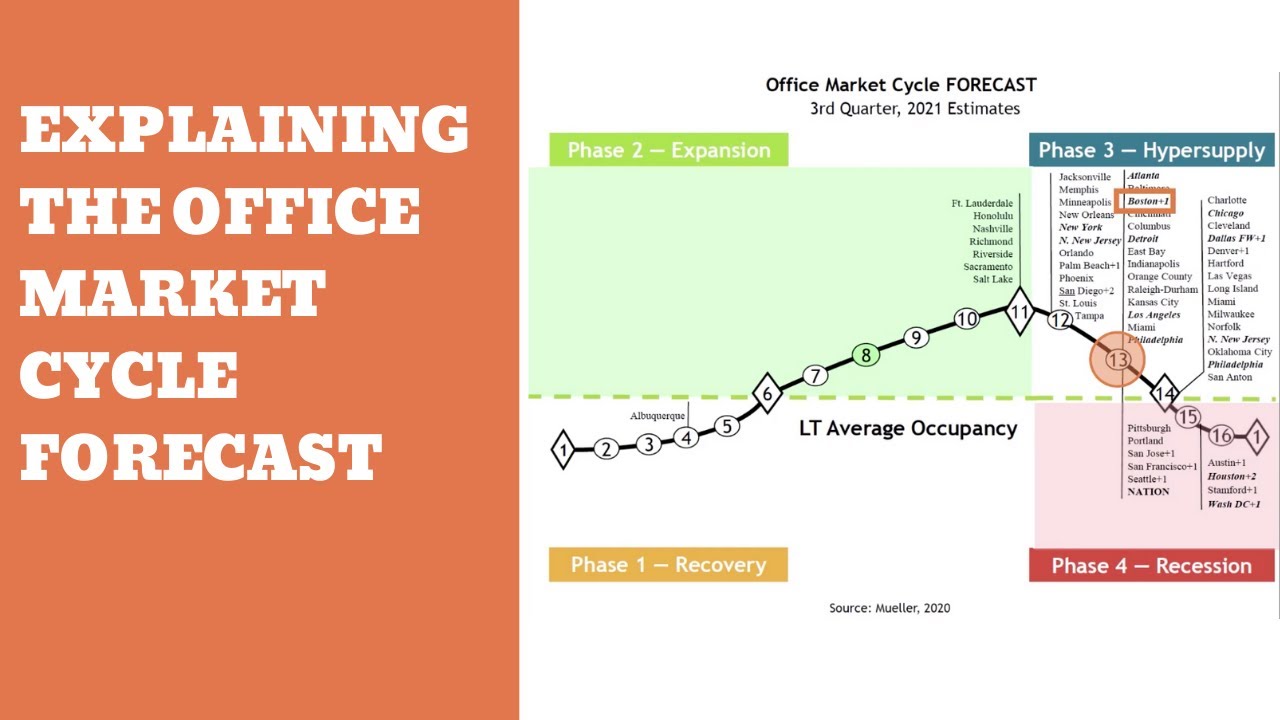

In this three-minute video, Jeremy Cyrier, CCIM President & Commercial Real Estate Advisor at MANSARD gives a 2022 update on the office market. Jeremy will take you through some new data, latest sales trends as well as what's happening in the markets.

The office market is a challenging asset class. It's become more and more difficult to underwrite, given the rapidly changing and reconfiguring of demand in the tenant market, for how companies are using office space. Pricing wise, we're seeing pricing bounced in 2020, and we saw this 2021 pricing that was actually pretty good, over $200 a square foot, but that seems to be showing signs of leveling in our market. I think that we've got some risks in the market, there's some deceleration happening. 2022 looks like it's going to be more of a 2018 or 2016 year, by number of trades for office buildings in the market. So, we may start to see some continued softening in the office market, as the tenant demand story unfolds, where we see leases starting to roll over. Determining whether we're going to see continued occupancy, or continued leasing of space, as companies try to sort out hybrid versus full time in the office.

If you want to be kept in the loop on what's going on, and if you are interested in learning more about us, you can visit our website at www.mansardce.com. We're here to help and if you have any questions, feel free to reach out. We look forward to seeing you on our next market update!

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: December 02, 2022

| Date Created: December 02, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research

| Office

| MASSACHUSETTS

Welcome to our How's The Market? update here at MANSARD. One of the things that we know here at the company is that finding the right commercial real estate buyer who performs on a deal can be hard to do, and bad deals made with wrong buyers lead to failed sales. It's embarrassing, and you can end up with a discounted sale price, which is a terrible thing. So, we developed a 42-point process to connect commercial real estate owners with high performing buyers who pay the right price so that they experience financially meaningful life events with their investments in real estate.

So, when you sell to the right buyer, you experience a financially meaningful life event with your real estate investment and that's what this is all about. That's why we develop and share these market insights in this data because if you don't understand what's happening in the market in real time, it's going to be hard to make the right real estate decision. So, we've taken data from Middlesex and Rockingham Counties. These are representative to the Boston suburbs and how we track the sale of retail, office, and industrial properties from 1 to 100 million on an annual basis. The reason why we do this is because we want to understand how making the right real estate decision fits into the overall timing of the market.

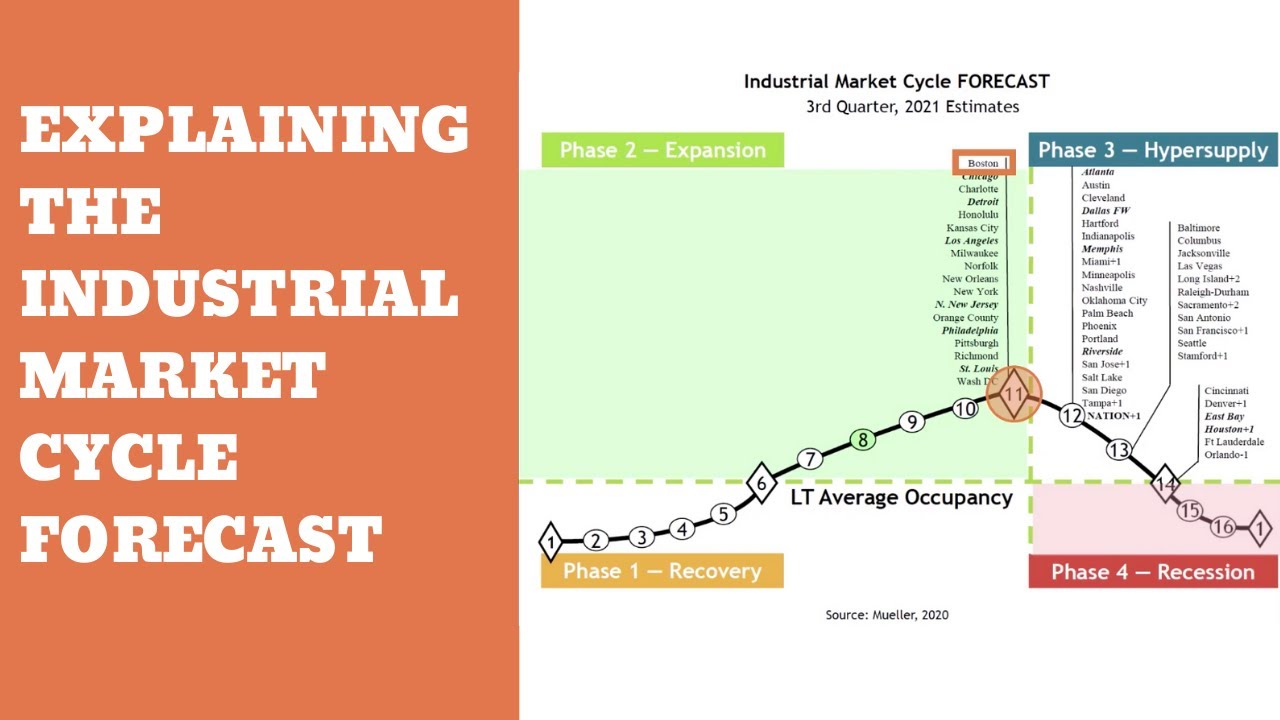

In this less than three-minute video, Jeremy Cyrier, CCIM President & Commercial Real Estate Advisor at MANSARD gives a 2022 update on the industrial market. Jeremy will take you through some new data, latest sales trends as well as what's happening in the markets.

The industrial market has really been the headline asset class for all of us in the real estate market. It's been very active, very tight, and we have seen a lot of new construction starting to come into the market over that 100,000 square foot mark, where it makes sense to build new supply in the market. If you're under 100,000 square feet, we're still seeing user demand that's highly active in that 15 to 50 to 60,000 square foot range. They are having a difficult time finding space in the market. These buildings are continuing to trade very aggressively.

2022, a very active year to date, and we're looking at a year that may end up having a similar number of buildings traded as 2020. It will not be as busy as 2021, but we still see industrial holding up as a very strong asset class with great pricing. You can see here the average price per square foot in the three counties we pulled the data from is in that $187-$188/foot range across all industrial, so a very strong asset class.

We are starting to see some rents leveling off and some pricing leveling off, and that's really being driven primarily by the interest rates in the market. Dr. Glenn Mueller here looking out into the second quarter of '23, he's saying Boston is at that peak phase, late expansion, where we're going to continue to see high demand for the asset class on the user side and the investment side.

If you want to be kept in the loop on what's going on, and if you are interested in learning more about us, you can visit our website at www.mansardce.com. We're here to help and if you have any questions, feel free to reach out. We look forward to seeing you on our next market update!

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: December 02, 2022

| Date Created: December 02, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial

| MASSACHUSETTS

Welcome to our, How's The Market? update here at MANSARD. One of the things that we know here at the company is that finding the right commercial real estate buyer who performs on a deal can be hard to do, and bad deals made with wrong buyers lead to failed sales. It's embarrassing, and you can end up with a discounted sale price, which is a terrible thing. So, we developed a 42-point process to connect commercial real estate owners with high performing buyers who pay the right price so that they experience financially meaningful life events with their investments in real estate.

So, when you sell to the right buyer, you experience a financially meaningful life event with your real estate investment and that's what this is all about. That's why we develop and share these market insights in this data because if you don't understand what's happening in the market in real time, it's going to be hard to make the right real estate decision. So, we've taken data from Middlesex and Rockingham Counties. These are representative to the Boston suburbs and how we track the sale of retail, office, and industrial properties from 1 to 100 million on an annual basis. The reason why we do this is because we want to understand how making the right real estate decision fits into the overall timing of the market.

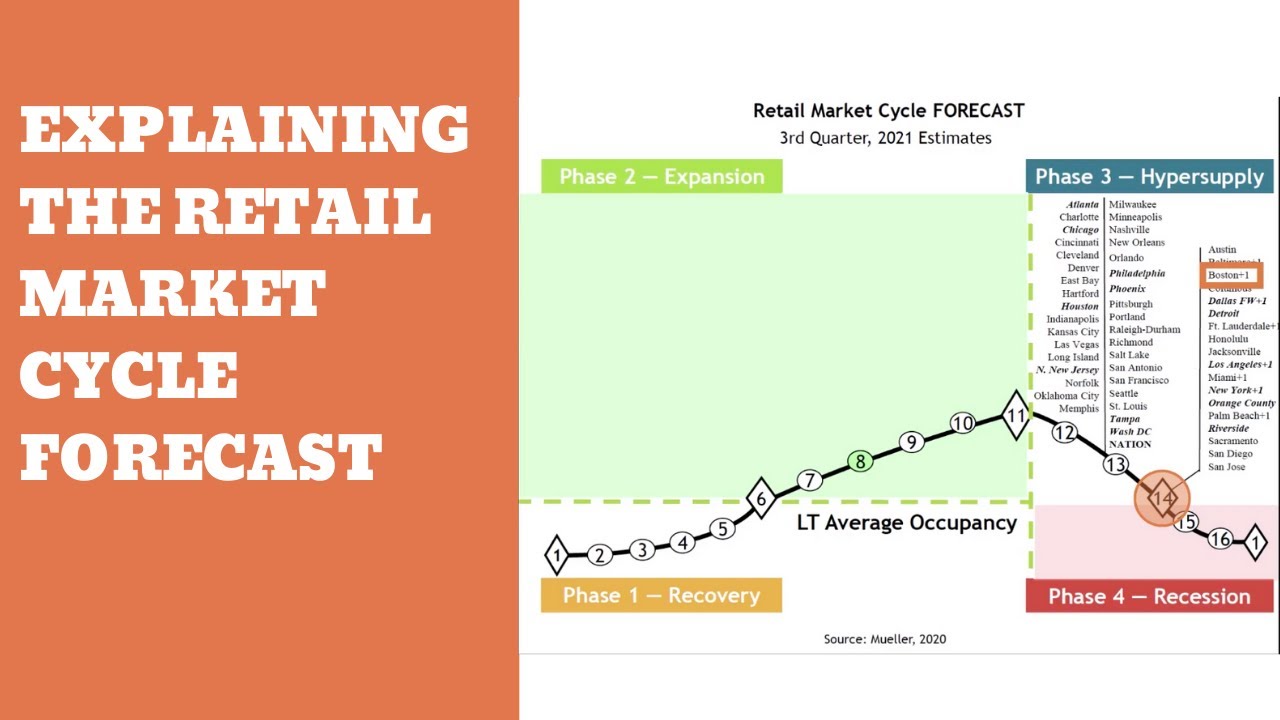

In this two-and-a-half-minute video, Jeremy Cyrier, CCIM President & Commercial Real Estate Advisor at MANSARD gives a 2022 update on the retail market. Jeremy will take you through some new data, latest sales trends as well as what's happening in the markets.

The big question right now is, what's the impact of interest rates going to be? How high are they going to go? And how long is this going to go for? We're going to look at what's happening in the market and how the data is showing us what is occurring.

If you want to be kept in the loop on what's going on, and if you are interested in learning more about us, you can visit our website at www.mansardce.com. We're here to help and if you have any questions, feel free to reach out. We look forward to seeing you on our next market update!

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: December 02, 2022

| Date Created: December 02, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research

| Retail

| MASSACHUSETTS

380 Main Street Wilmington, MA is a well-maintained mixed-use building with a long history of high occupancy rentals and dependable rent growth. The property consists of 1 retail space and 5 residential units. With easy access to I-93 and the Wilmington MBTA station across the street, 380 Main Street is 100% occupied with long-term tenants below market rents. The current owner has made many updates to the property including new windows and updated electric service. The 4,415.0 SF 6-unit mixed-use building is set on Main Street in Wilmington, MA. With easy access to I93 and Commuter Rail Wilmington T stop, this location is perfect for any small business looking for steady income through retail storefronts while generating income from residential apartments. Wilmington is a town in Middlesex County, Massachusetts, United States. Its population was 23,349 as of the 2020 United States Census. This property has been meticulously cared for and updated by the current owner. The first level features two commercial storefronts that are both leased on a NNN basis with long-term tenants in place. There are also two one-bedroom apartments on the second level that have been updated and are currently leased.

Want to learn more? https://masscommercialproperties.com/...

Are you looking to sell your commercial real estate?

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

00:00 Introduction

00:53 Approaching the market

01:27 When buyers ask for extensions

02:34 What happens with the 3rd buyer

MANSARD | Date Uploaded: September 30, 2022

| Date Created: September 30, 2022| Commercial Properties for Sale

| Multifamily, Retail, Mixed-Use: Multifamily / Retail

| MASSACHUSETTS

In this video Josh discusses his recently closed listing 154 Center Street, Groveland, MA. A 7,200 SF industrial property that he successfully took off the market.

Zoom Highlights:

Jeremy:

I wanted to catch up this morning and talk about Groveland. You just closed on a sale there. It was a business owner who sold his company, and came to us because he had the industrial building where he was housing his company left over and wanted to get rid of it.

Josh:

He owned this company and he owned the real estate together. He operated his company out of the building and then ended up selling the company, and so he was stuck with the real estate. The lease was ending for the company. That company was then purchased by another company and they were planning on moving out of the property, so he was going to be stuck with vacant property in about six months from the time we took it on.

Josh:

Basically he had attempted to market it himself, and was just getting bogged down with a lot of tire kickers and low offers, and was just unhappy with the market and how they were coming to him. He wanted to get some professional help, and so we took him on as a qualified seller. We met with him, we brought him through our process, and determined that he was a qualified seller.

Jeremy:

What you're saying is this guy had sold his company, the company that bought his company signed a lease for say six months while they transitioned the operations out of the building, so he was facing a looming vacancy. He no longer needed the building, so he tried to market the building himself, find buyers, and ended up with a lot of tire kickers, people who were coming in, making lowball offers, really spinning his wheels and wasting his time. Would you say that the sale of this piece of real estate in Groveland was critical to his retirement plan?

Josh:

It was. He was going to be stuck with an asset with negative cash flow, and he wanted to sell the property to be able to retire with his wife, actually.

Jeremy:

Interesting. He had successfully sold the company, which is not easy to do, then he had the building left over. Needed to dispose of that so he could transition the equity, this was a big deal for him and get as much capital out of the property as possible, so he could retire with his wife?

Jeremy:

After trying to do it himself, he hired our team, and you spearheaded the effort to take them through our sale process. Tell me what happened when you went to market.

Josh:

We went to market and we had a lot of good activity. There were a few lowball offers, but essentially we sourced four offers on the property. All of them were above what he was actually looking to get, and we ended up selling on a deal with a direct user. During that time there was some difficulties, and that deal ended up falling through. Through our continuous marketing period, we were able to set up a new deal within 30 minutes of the old one falling apart.

Jeremy:

In terms of the sale price, so the high to low, he had gotten offers on his own. What was a typical offer price he was seeing in the market for his building?

Josh:

When he was trying to market it himself, he was seeing offers from 700,000. Someone offered him 500,000 and they were all under a million, which he wasn't too happy with.

Jeremy:

1.25 was the final sale price, so he ended up selling about 500,000 to 750,000 over the lowball, time-wasting people that were coming to him. Maybe they sensed that he was motivated, not in the right way, to exit the building, because he had sold his company. Maybe he was showing some of that to the market, that he was nervous, and they were taking advantage of that. Having us run the process and be his intermediary and representing him, we were able to protect his interest from the market seeing those things and then negotiate the highest value. An extra half a million in his retirement with his wife, a big deal for this guy, right?

Josh:

First-time seller, very nervous. I think some people sense that, try and take advantage of that. He was scared of making a mistake, because this was a significant transaction for him. This was his retirement, and he didn't want to mess that up.

Jeremy:

Yeah. It's not uncommon. We see one of the primary reasons why people end up selling a piece of commercial real estate is because they've sold, closed or relocated their company. This was exactly one of those reasons why. He's not a professional commercial real estate investor. He doesn't do this every year or three years or five years. This is the kind of thing where he has a facility that is now surplus and he needs to sell it, but it goes into the whole picture of maximizing his returns, getting as much money out as possible, because this is a direct investment for this gentleman, and making sure that he realized the full market value of the property was essential to him feeling confident about his sale.

MANSARD | Date Uploaded: August 24, 2022

| Date Created: August 24, 2022| Commercial Properties for Sale, Brokerage

| Industrial

| MASSACHUSETTS

Check out our latest video with Josh Bartell at 1141Bridge Street, Lowell, MA

1141 Bridge Street is a 5,352 SF building that is 100% leased to 3 quality tenants. This stand alone retail property was constructed in 2011 with recent renovations 2019. The property has surface level parking, has been meticulously maintained, features low maintenance construction materials, 19 parking spots, and is located in Lowell, MA. The existing tenants include Smiley Dental, People Ready, and Bark Avenue. The property is shadow anchored by Market Basket with other nearby national retailers which include Dunkin Donuts, McDonald's, Subway, and more. The site benefits from close proximity to residential neighborhoods and has easy access to public transportation including the MBTA Bus line with over 13,000 vehicles passing per day.

Want to learn more? https://buff.ly/3QiHaSe

Are you looking to sell your commercial real estate?

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: August 08, 2022

| Date Created: August 08, 2022| Commercial Properties for Lease, Commercial Properties for Sale

| Office, Retail, Other, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail

| MASSACHUSETTS

The best way to sell a commercial property is to have an ongoing commercial property marketing strategy that keeps buyers interested in your commercial real estate sale.

In this video, I share the #1 provision to eliminate in your buyer's offer. And I'll show how one owner achieved a 10X equity multiple allowing the buyer to double its food distribution to 10M tons of food per year.

See why continuous marketing is the best way to sell commercial property to the right buyer for the right price with confidence.

Are you looking to sell your commercial real estate?

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: August 03, 2022

| Date Created: August 02, 2022| Commercial Properties for Sale, Brokerage, Educational Programs

| ALL

| ALL

Looking to invest in real estate and want the 1031 exchange explained? Make sure you understand the 1031 exchange rule with this free 45 day rule checklist!

The 1031 exchange rule is a complicated but important process for investors. This checklist will make sure you understand the basics and are able to take advantage of this tax break.

~~~~

Get the 45 Day Checklist here: https://1031prostrategies.com/

~~~~

When it comes to 1031 exchanges explained, there's one strategy that is most important. And that is don't make the mistake of being stuck between making a bad real estate deal or paying taxes. It's not a good place to be. So in today's video, I'm going to talk to you about one of the most important pieces of the process, which is the 45 day identification period.

So when you're doing a 1031 exchange, there are multiple rules that you have to follow. And the main rule that will drive you crazy is the timing rule. The timing rule is the number one reason why investors opt out of 1031 exchanges.

Go there. You can put in your name, your email, and then we'll send you back a copy of the checklist so you can download it, open it in Excel and use it. It's free. I'm sharing it with you today. I'm hoping that you can use this to save yourself some stress and anxiety as you go through the 45 day identification period.

It was nice talking to you today. My name's Jeremy Cyrier with Mansard. Please subscribe to our channel and turn on the notification bell. And if you have a comment for us below, I'd love to hear from you, any questions you have about the ID period. We do monitor the comment section and we'll reply to your questions there. Look forward to seeing you in the next video. Thanks.

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

00:00 1031 Exchange Explained

01:29 How Professional 1031 Investors Plan

02:21 Start your search before your sale

03:41 The 45 day ID checklist

MANSARD | Date Uploaded: August 03, 2022

| Date Created: July 28, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Educational Programs

| ALL

| ALL

As a business broker, you deserve to made real estate sales easy for your client. You client wants to sell their company but does not want to make costly mistakes in selling their real estate. Therefore, as their business advisor, they look to you to evaluate their real estate, which at times may be one of the most significant assets in their sale.

You shouldn't worry about how to best approach real estate when securing the highest valuation for your client's business.

That's why we're sharing two of the most popular approaches to valuation used by the commercial real estate sales experts at MANSARD, named to the Boston Business Journal's list of top selling commercial real estate brokerages in Massachusetts for 2022.

Get access to the cap rate calculator: www.Combinedsales.co

~~~~

Subscribe to MANSARD’s Youtube Channel: https://www.youtube.com/channel/UCGn7...

~~~~

Check Out Our Latest Video: https://www.tubebuddy.com/quicknav/la...

~~~~

Get Your Selling & Capital Gains Tax Guide: https://masscommercialproperties.com/...

~~~~

Want to know how to calculate commercial real estate value? https://masscommercialproperties.com/...

~~~~

Connect with MANSARD on LinkedIn: https://www.linkedin.com/in/jeremycyr...

~~~~

Follow MANSARD on Facebook: https://www.facebook.com/mansardcre

MANSARD | Date Uploaded: July 27, 2022

| Date Created: July 18, 2022| Commercial Properties for Sale, Brokerage, Educational Programs, Appraisal

| Industrial, Medical, Office, Retail

| MASSACHUSETTS

Mixed-Use value-add opportunity located in the heart of Wakefield center. This 18,500 +/- SF mixed-use property is 50% occupied with value upside through renovating and leasing the second floor as retail/office space or redeveloping the second floor into residences. Rated with a (91) Walker's Paradise Walkscore, 401-411 Main Street is minutes to the MBTA commuter rail, some of Wakefield's best dining, and scenic Lake Quannapowitt.

MANSARD | Date Uploaded: July 18, 2022

| Date Created: July 13, 2022| Commercial Properties for Sale

| Medical, Office, Retail, Mixed-Use: Office / Retail

| MASSACHUSETTS

Mixed-Use value-add opportunity located in the heart of Wakefield center. This 18,500 +/- SF mixed-use property is 50% occupied with value upside through renovating and leasing the second floor as retail/office space or redeveloping the second floor into residences. Rated with a (91) Walker's Paradise Walkscore, 401-411 Main Street is minutes to the MBTA commuter rail, some of Wakefield's best dining, and scenic Lake Quannapowitt.

MANSARD | Date Uploaded: July 11, 2022

| Date Created: July 11, 2022| Commercial Properties for Sale

| Office, Retail, Mixed-Use: Office / Retail

| MASSACHUSETTS

If you're looking to sell your commercial real estate fast, there are a few things you can do to make it happen. Here are 5.5 tips in this 3-minute video to help you get started on selling your commercial property quickly.

If you like this video, click here to read more: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 11, 2022

| Date Created: June 22, 2022| Commercial Properties for Sale, Brokerage, Educational Programs, Property Services/Inspections, Title/Escrow/Closing

| ALL

| MASSACHUSETTS

Looking to invest in commercial real estate? Here are the latest sales trends to watch in Greater Boston. Whether you're interested in purchasing a property or simply keeping up with market changes, this video will give you the information you need to make informed decisions. Thanks for watching!

Links to Sources:

https://masscommercialproperties.com/...

https://www.greenstreet.com/insights/...

https://www.costar.com/

https://www.stdb.com/crepi

MANSARD | Date Uploaded: July 11, 2022

| Date Created: June 21, 2022| Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Industrial, Office, Retail

| MASSACHUSETTS

Check out our Top 3 Industrial Sales in the Medford/Malden Submarket with Josh Bartell.

MANSARD | Date Uploaded: July 11, 2022

| Date Created: June 16, 2022| Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Industrial, Office

| MASSACHUSETTS

When you're looking to buy or sell a commercial property, it's important that you have a realistic idea of its commercial property valuation. In this video, we'll take a look at how to choose the right commercial property valuation sales comp.

MANSARD | Date Uploaded: July 11, 2022

| Date Created: June 09, 2022| Commercial Properties for Sale, Brokerage, Educational Programs, Appraisal

| ALL

| MASSACHUSETTS

Commercial real estate can be a great investment, but how to find a commercial real estate buyer and feel assured that you've found the right one is not easy. In this 2 minute video I'll share with you my number one tip for easily identifying the right commercial real estate buyer for your property.

I'm also sharing a free PDF report on how to find commercial real estate buyers to pay you the right price.

Get your free download: How to Get the Right Price for Your Commercial Real Estate: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 11, 2022

| Date Created: June 02, 2022| Commercial Properties for Lease, Commercial Properties for Sale

| ALL

| MASSACHUSETTS

Commercial real estate is a complex and ever-changing market. When pricing your property, it's important to weigh all of the pros and cons of publishing your commercial real estate price to ensure you get the best return on your investment. Watch this video for more information about how to price to get the highest commercial real estate value.

_________________________

How to calculate commercial real estate value: https://masscommercialproperties.com/...

FREE REPORT: Six Signs it's Time to Sell: https://masscommercialproperties.com/...

__________________________

MANSARD | Date Uploaded: July 11, 2022

| Date Created: May 25, 2022| Commercial Properties for Sale, Brokerage, Educational Programs

| ALL

| MASSACHUSETTS

585 Middlesex Street is a 100% net-leased, LEED Gold office building located in the center of Lowell, MA. Originally the Davis and Sargent historic mill constructed from bedrock quarried from the abutting canal, the property was subsequently renovated as a LEED Gold recipient the property incorporates sustainable elements including solar panels, high-efficiency heating, plumbing, and electrical systems, pervious pavement, and the use of non-VOC emissions construction materials. The building is leased by the NOBIS Group, which is an integrated consulting firm that provides engineering and environmental solutions for public and private projects of all sizes.

Learn More: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 11, 2022

| Date Created: May 19, 2022| Commercial Properties for Sale

| Office

| MASSACHUSETTS

There are many reasons why investors might choose to sell their commercial real estate holdings. In this video, we explore the top 6 reasons investors are selling commercial real estate.

Whether you're looking to cash in on investments or simply move on to new opportunities, it's important to understand the factors that can influence a commercial real estate transaction. Watch this video for a closer look at the top six reasons investors are selling in 2021 vs 2022.

Access the Infographic here: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 11, 2022

| Date Created: May 18, 2022| Commercial Properties for Lease, Commercial Properties for Sale

| ALL

| MASSACHUSETTS

Commercial real estate is a valuable asset, and it's important to understand how to calculate its value. In this 7 minute video, I explain the cap rate and show you how to use it to determine the value of a commercial property.

You'll also see an easy excel tool that allows you to use real-world factors that help you feel confident about the commercial real estate value you've reached.

Top 5 Questions to Ask your Commercial Estate Broker: https://masscommercialproperties.com/...

Request a Consultation with Jeremy: https://mansard.as.me/schedule.php

Thank you Mike Lipsey for the inspiration for this tool: https://lipseyco.com/

MANSARD | Date Uploaded: July 11, 2022

| Date Created: May 12, 2022| Commercial Properties for Sale, Brokerage, Educational Programs, Lending / Finance

| ALL

| MASSACHUSETTS

As interest rates rise, what does this mean for commercial real estate?

In this video, we take a look at how rising interest rates could impact the commercial real estate market. We'll also explore some of the potential opportunities and challenges that could come with increasing rates.

To reach Dave:

Dave Gambaccini, CCIM

Senior Advisor | New Hampshire

Financial Services

dave.gambaccini@colliers.com

Mobile: +1 603 540 1433

To reach Jeremy:

www.Mansardcre.com

MANSARD | Date Uploaded: July 11, 2022

| Date Created: May 05, 2022| Economics/Market Reports/Research, Lending / Finance, Interviews / Speeches

| ALL

| MASSACHUSETTS

If you're a business owner who is selling your business, but the buyer doesn't want to take on the real estate, don't worry! There are three simple things you can do to prepare to get the property off of your hands and into the hands of the right buyer. In this video, I'll share those tips with you.

MANSARD | Date Uploaded: July 05, 2022

| Date Created: April 29, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Brokerage

| Industrial, Office, Retail, Restaurant

| ALL

As the Greater Boston commercial real estate market continues to grow and evolve, it's important to stay up-to-date on the latest sales trends. In this video, we'll take a look at the most important trends to watch.

MANSARD | Date Uploaded: July 05, 2022

| Date Created: March 11, 2022| Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Industrial, Multifamily, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

Wondering what your Andover, Massachusetts commercial real estate value might be? Or how much would the right buyer pay for your Andover, MA commercial property today?

Commercial property value in Andover, Massachusetts fits into two markets -- the corporate user and the local services market. Investors like the Andover office and industrial market because of the access to a strong labor base, while the retail market serves a high-income population that demands amenities and services. In the last 12 months, over $70.1M in properties traded across nearly 256 buildings in a community of 36,403 people.

Get your Andover, Massachusetts commercial property value here: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: August 02, 2021

| Date Created: | Commercial Properties for Sale, Brokerage

| Industrial, Office, Retail

| MASSACHUSETTS

Request a free consultation by calling (617) 674-2043 or visiting https://masscommercialproperties.com/

We all want to know where the commercial real estate market's headed. The problem is we don't the future. In this video, Jeremy Cyrier, CCIM walks through pricing trends, dollar volume and year over year comparisons for the greater Boston commercial real estate market so that you can sell your high value commercial property with confidence.

So where is the greater Boston commercial real estate market going to end in 2019?

Great question. So one of the things we do here at MANSARD, where we help owners find the right buyers for their high value commercial properties, is we track three counties: Rockingham, Essex, and Middlesex counties, which are west and north of Boston. The reason we do that is because those three counties, we find across the 80 towns that are included in them, share a very similar socioeconomic fabric.

Compared to last year, 2018 was really a record year for the greater Boston commercial real estate market.

We saw about $1.728 billion in volume, in the one to $20 million market, so record setter. Over the last 12 years, since 2006 to 2018, highest volume year to date. So 2019, where does that put us? Currently, on an annualized basis, we're looking at ending the year about 17% over the long-term average. So that means that we're above where the market typically trades on a long-term average since 2006, but we're not headed for a record year this year, compared to 2018. In fact, this time last year, in 2018, we were at 443 sales, this time, we're at 373. So what that tells us is the market slowed a little bit from last year, but the dollar values are still high. In fact, we're at about $1.2 billion in trades.

What does this mean for retail, office, flex, and industrial in the greater Boston commercial real estate market?

Well, office across those three counties, between one to $20 million is trading about 5% over its long-term average right now. In fact, that's down from 2018, which was showing an average price per square foot at $152 a foot. We're currently at about 113, does that mean the office market is correcting or softening? I don't believe so, I think it's too early to tell. There are some low basis trades in the volume that could be contributing to those numbers, so we'll need to see over the next couple of months how that shakes out.

Industrial, however, if you're reading the press, you're seeing that that's a very strong sector.

In fact, it's 43% over its long-term average. This is the best industrial market Boston's probably ever seen. Retail, 19% over its long-term average. In terms of value and flex, 25% over. So what does this all mean? How does it roll up? Well, with the feds lowering interest rates this year, I believe they've protracted the cycle, so we're definitely in a mature phase of the cycle, so we're still seeing high volume, but I am not seeing rapid appreciation this year. What I am seeing are very high values, a lot of investors looking for good deals, smart cash flows, long-term holds, but deals are still around. There's still great fundamentals of the market, and we're seeing the suburban markets still trade very actively.

I appreciate your checking us out. If you want to follow our greater Boston commercial real estate market updates, you can subscribe to our channel right here at YouTube or request a consultation at (617) 674-2043. Thank you.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

In this video, Jeremy Cyrier, CCIM reviews the Rockingham, Middlesex and Essex County market in Massachusetts and New Hampshire, which includes the following towns:

Cambridge

Waltham

Marlborough

Framingham

Somerville

Woburn

Billerica

Newton

Lowell

Salem

Wilmington

Lawrence

Natick

Portsmouth

Peabody

Watertown

Danvers

Malden

Burlington

Andover

Everett

Haverhill

Bedford

Chelmsford

Medford

Lynn

Lexington

Beverly

Tewksbury

Arlington

Newburyport

Acton

North Andover

Reading

Saugus

Hudson

Concord

Holliston

Wakefield

Belmont

Methuen

Derry

Gloucester

Hopkinton

Westford

North Reading

Winchester

Seabrook

Seabrook

Salisbury

Littleton

Londonderry

Melrose

Wayland

Amesbury

Tyngsboro

Ipswich

Exeter

Hampton

Middleton

Ayer

Stoneham

Plaistow

Boxborough

Windham

Dracut

North Hampton

Rowley

Rowley

Hampstead

Swampscott

Epping

Epping

Chelsea

Newmarket

Rockport

Boxford

Groveland

Newtonville

Waban

MANSARD | Date Uploaded: August 02, 2021

| Date Created: November 15, 2019| Commercial Properties for Sale

| Industrial, Office, Retail, ALL

| MASSACHUSETTS

We all want to know where the next hot spot will be in the greater Boston commercial real estate market. But how? And how can we identify where those emerging markets will be? today Jeremy takes us through trends in the market and how the urban real estate cycle that's coming to an end will likely be followed by a suburban real estate cycle and which areas to watch.

We all want to get the right price for our high-value commercial properties. But it can be difficult to find the right buyer. In this free guide, I share steps to take to avoid doing a bad deal with the wrong buyer, which could end up costing you six to seven figures in sales proceeds.

Request your here: https://masscommercialproperties.com/...

Which Boston sub-market is most undervalued. Subscribe to our channel for tips to find the right buyer to sell your high-value commercial real estate with confidence.

So which sub-market around Boston is most undervalued? Well, in this market cycle we've been in, we've seen urbanization of the market and basically what's happened is employers and population have centralized in the city. That's been great. There's been a phenomenal expansion in Boston. A lot of construction has happened. And the inner burbs, so really still part of kind of the Boston socioeconomic center have also seen that same kind of expansion. As a result of that, we've seen a run-up and values. We've seen a lot of properties turning trading hands. So where does that leave undervalued opportunities? Well, here's where I see it happening. In the suburbs. In fact, it's the suburban belt between 128 and 495 that's where the next area of opportunity is. And the reason why I say that is because the population that's moved into the city has been driven primarily by millennials and retiring baby boomers.

The two things that they don't have are households with kids. That's something that's going to change. So millennials are going to start getting married, they're going to start having kids and one of the things they're going to consider is, "Where should we be living in order to provide the type of experiences that we have enjoyed in the city, but are also close enough to work where we can raise a family and enjoy yard, free parking off-street, and still have access or walkability to a nice town center?"