VIDEO SEARCH

2421 videos found

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market. Opening Keynote highlights with Bruce Ford of Lodging Econometrics from [CLIC] 5. Thank you Bruce......

[CLIC] | Date Uploaded: May 11, 2022

| Date Created: May 11, 2022| Economics/Market Reports/Research, Events / Webinars, Interviews / Speeches

| Hospitality

| ALL

Tune in to this episode of #coffeebreak as Blake Peterson describes what it's like to manage #lifesciences space versus a standard #office building.

Transwestern | Date Uploaded: May 10, 2022

| Date Created: May 09, 2022| Commercial Properties for Lease, Interior Design, Property Management

| Office, Life-Science

| ALL

In episode 2 of this #coffeebreak series, Rosie Keller discusses trends she is seeing and how they accommodate new work patterns as tenants make their way back into the office.

Transwestern | Date Uploaded: May 10, 2022

| Date Created: May 09, 2022| Commercial Properties for Lease, Interior Design, Property Management, Tenant Concepts, Interviews / Speeches

| Office

| ALL

Has the #industrial sector embraced #sustainability? Tune into this #coffeebreak episode and hear from our experts, Josh Richards and Walter Byrd, as they provide their insights.

Transwestern | Date Uploaded: May 10, 2022

| Date Created: May 09, 2022| Commercial Properties for Lease, Interior Design, Property Management, Tenant Concepts, ESG (Environmental, Social and Governance), Interviews / Speeches

| Industrial, Office

| ALL

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our interview show. Joining us today is Nirav Shah of Hyatt Hotels Corporation. We are talking Brands, Hotels, Brand Conversion, all aspects of the hospitality industry, while focusing on leading with empathy and humility. Explore development opportunities with Hyatt Hotels Corporation and discover the difference of world-class brands, innovative design, operational excellence, and industry-leading sales and marketing strategies.

[CLIC] | Date Uploaded: May 03, 2022

| Date Created: May 03, 2022| Development/Planning/Entitlements, Interviews / Speeches

| Hospitality

| ALL

The opening session at the CRELC LA features Izek Shomof & Bill Taormina discussing the Life Rebuilding Center project in Los Angeles to help solve the Homeless Crisis at the Commercial Real Estate & Lending Conference on April 26, 2022 at the Sheraton Universal Hotel in Hollywood.

All Star Group | Date Uploaded: May 02, 2022

| Date Created: May 02, 2022| Development/Planning/Entitlements, Events / Webinars, News

| Multifamily, Mixed-Use: Multifamily / Retail

| CALIFORNIA

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our interview show. Joining the conversation today is Eric Paulsen of Kidder Mathews. With over 1000 CRE Brokers and Agents in Orange County, we are cutting thru the noise and I am stepping outside of my comfort zone. We are talking CRE in So Cal & AZ, Cap Rates, Interest Rates, 1031 Exchanges/Replacement Property, Best & Worst of Class, Prop 13, Leadership and so much more.

Please tour our website at cliconference.com.

[CLIC] | Date Uploaded: April 28, 2022

| Date Created: April 28, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Brokerage

| ALL

| ALL

We are lucky to get a tour of the stunning Zaha Hadid & Related building at 520 W. 28th street by the developer himself, Greg Gushee. Greg shares his passion project within this incredible building known as Sandbox by Related. This highly unusual and innovative space is a rare amenity to the residents of 520 W. 28th and its greater community, inviting children and adults alike to come into the space and create. From 3D printers, DIY rocket building, VR gaming to a full on derby racetrack, this space has something for everyone. The fun doesn’t stop there though, Greg continues the tour showing us the building IMAX theater and versatile art gallery called The Highline Nine.

Diving head first into the world of Virtual Reality, we head over to see our friend D.J. Smith, Co-Founder and Chief Creative Officer of The Glimpse Group. D.J. is well known in the VR/AR industry as the Organizer of NYVR Meetup group amongst the many things he does for the NYC ARVR community. He walks us through the latest and greatest applications of mixed reality and where it intersects with the built world. Although, we could not talk virtual reality without a visit to VR World located right across the street from the Empire State Building. We meet up with VR World Founder, Leo Tsimmer to understand what this retail space is all about. Leo gives us an education on experiential retail and how he has transformed the space into a full fledged virtual playground.

JLL TV | Date Uploaded: April 25, 2022

| Date Created: February 23, 2022| Residential Properties for Lease, Architecture, Development/Planning/Entitlements, Technology / Proptech, ESG (Environmental, Social and Governance), Interviews / Speeches, Virtual Tours

| Multifamily, Office

| NEW YORK

California Lodging Investment Conference [CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our official interview show. Our Guest today is Christine Trippi is an Author, Energizer (only person that has as much energy as Glenn Haussman), Trainer, Consultant and the CEO at The Wise Pineapple. We are talking Books Yes, Is The Answer, Leadership, Team Building, Puppies, Keynotes and so much more...... The Wise Pineapple & Aloha Craig together for the first time on [CLIC] Connect....

If you think Glenn Haussman of No Vacancy & Craig Sullivan of [CLIC] Connect should do a Quarterly Book Club show??? Please comment below. Thank you.....

[CLIC] | Date Uploaded: April 21, 2022

| Date Created: April 21, 2022| Marketing/PR, Interviews / Speeches

| Hospitality, ALL

| ALL

[CLIC] is the only Hotel Conference that focusses on the California Hotel Market. What a great day here are a few of the highlights from the 5th Annual California Lodging Investment Conference on March 10th, 2022 at the Crown Jewel of the Anaheim Resort the JW Marriott. Thank you to our Attendees, Sponsors, Speakers, Exhibitors, Conference Producer Arnie Garfinkel, [CLIC] Connect Producer, Director & Editor Danyetta Leffler for making this sizzle reel, our AV Team AV Pros, The Ownership Group of the JW Marriott and its on-site Team, my Son Shawn and so many others, Please tour our website at cliconference.com. Thank you All so very much....

[CLIC] | Date Uploaded: April 20, 2022

| Date Created: April 20, 2022| Events / Webinars

| Hospitality

| ALL

California Lodging Investment Conference [CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our official interview show. Joining the conversation today is James Ferguson is an Award Winning GM, Public Speaker, Team Builder, Leadership Development & Executive Coach, Corporate Trainor, Author, Podcaster to mention a few... James and Craig are talking Leadership, Daily Huddle, Team Building, Confetti Culture and so much more......

Should Glenn Haussman of No Vacancy & Craig Sullivan of [CLIC] Connect do a monthly or Quarterly Book Club Show? Please leave a comment below. Thank you.....

Please tour our website at cliconference.com.

[CLIC] | Date Uploaded: April 19, 2022

| Date Created: April 19, 2022| ESG (Environmental, Social and Governance), Employment / Jobs, Interviews / Speeches

| Hospitality

| ALL

Charles and Dalton from DMG, Inc. reveal deferred conditions on a commercial real estate industrial building that sometimes people don't know anything about. This segment is what happens when you have cracks on your interior and exterior commercial building walls. Although it may seem cosmetic, exterior cracking can mirror the interior causing all kinds of moisture intrusion havoc!

DMG | Date Uploaded: April 13, 2022

| Date Created: April 05, 2022| Property Management, Property Services/Inspections

| ALL

| ALL

Charles and Dalton from DMG, Inc. reveal deferred conditions on a commercial real estate industrial building that sometimes people don't know anything about. This segment is what happens when there are not enough AMPs and Voltage in your Commercial Building to support your site use.

DMG | Date Uploaded: April 13, 2022

| Date Created: April 05, 2022| Property Management, Property Services/Inspections

| ALL

| ALL

Charles and Dalton from DMG, Inc. reveal deferred conditions on a commercial real estate industrial building that sometimes people don't know anything about. This segment is what happens when moisture and dirt collect on interior warehouse walls. Although you may not see it, it could lead to serious health and safety complications.

DMG | Date Uploaded: April 13, 2022

| Date Created: March 30, 2022| Property Management, Property Services/Inspections

| ALL

| ALL

Charles and Dalton from DMG, Inc. reveal deferred conditions on a commercial real estate industrial building that sometimes people don't know anything about. This segment is what happens when your exterior paint has cracks. Although it may seem cosmetic it could lead to disastrous conditions.

DMG | Date Uploaded: April 13, 2022

| Date Created: March 23, 2022| Property Management, Property Services/Inspections

| ALL

| ALL

Find out what Paul's Nickname is by watching the video.

DMG | Date Uploaded: April 13, 2022

| Date Created: March 16, 2022| Property Management, Property Services/Inspections, Marketing/PR

| ALL

| ALL

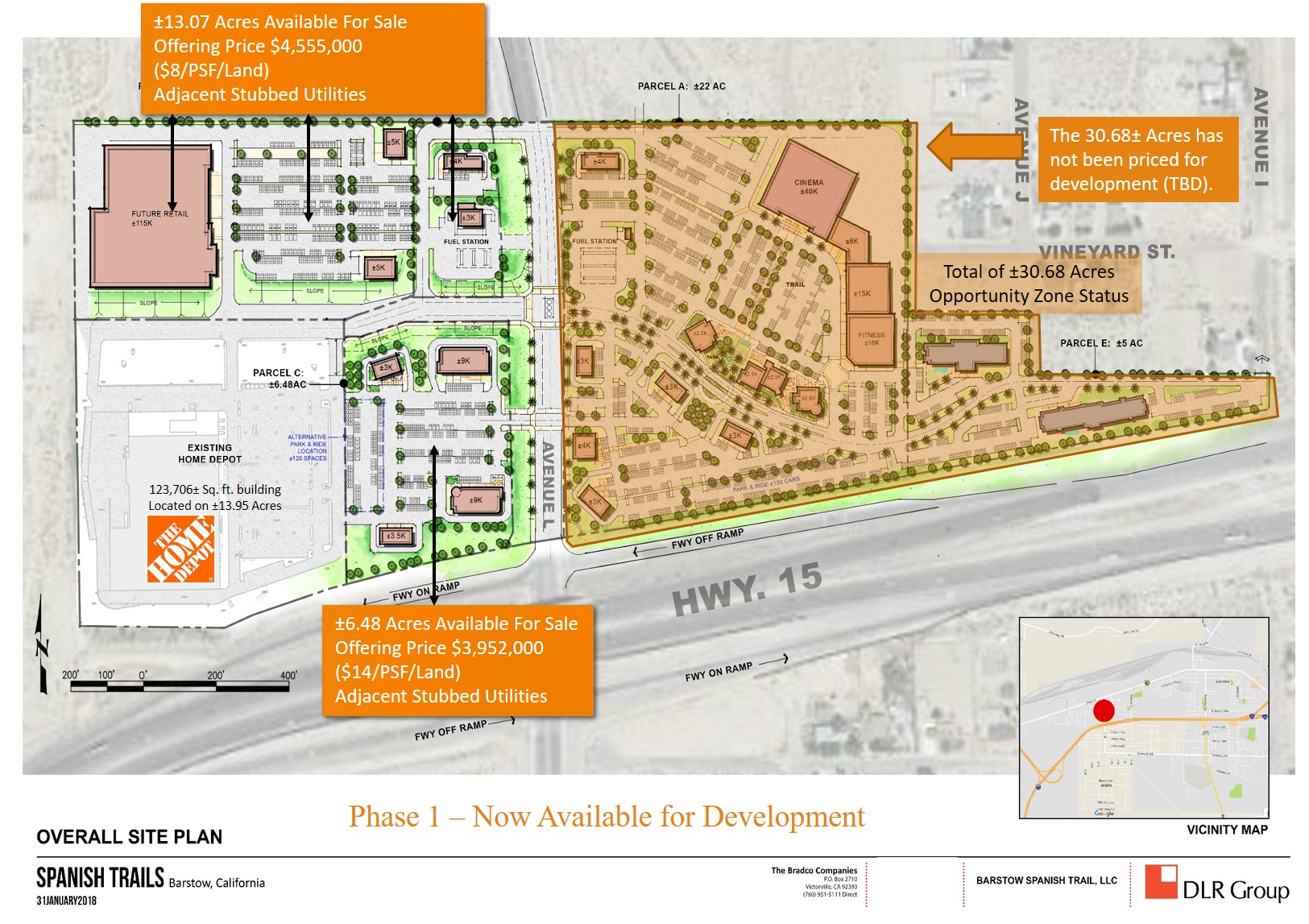

"The Shops at Spanish Trail" is a fully approved Specific Plan 112.4± acre (801,000±SQ. FT.) mixed-use development with

±50.83 net acres immediately available for sale and development. Anchored by an existing Home Depot on 13.95±acres with a 123,706±Sq. Ft. building, the property has prominent exposure and ease of access directly from the I15 Freeway

at Main Street & Historic Route 66. *****

Potential Land Uses Include:

**Family Entertainment

**Mixed Retail

**Service Stations

**Hotel/Motel

**Electric Vehicle charging stations

**Roadside Food Halls

**Dine-In & Fast Food

**Senior Housing/Assisted Living

**Market Rate Multi-Family Rentals

*****For more info, contact Joseph W. Brady, CCIM, SIOR at JBrady@TheBradcoCompanies.com**Office: (760) 951-5111 x101**Cell: 760.954.4567****

The Bradco Companies | Date Uploaded: April 12, 2022

| Date Created: April 12, 2022| Commercial Properties for Lease, Commercial Properties for Sale, Residential Properties for Sale, Brokerage, Construction, Development/Planning/Entitlements, Historical, Infrastructure, Property Management

| Hospitality, Industrial, Land, Retail, Transportation, Other, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Senior Housing, Self-Storage, Restaurant

| CALIFORNIA

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our interview show. Joining us today is Arnie Garfinkel Founder & President of the All Star Group Events. We are talking about CRE & Hospitality Loans. the Commercial Real Estate & Lending Conference or CRELC on April 26th, 2022 at the Sheraton Universal Hotel, The LoanMakers Forum, Deal Savers and the New Focus Networking and so much more. We have a [CLIC] Discount Code for you during the interview....

[CLIC] | Date Uploaded: April 12, 2022

| Date Created: April 12, 2022| Events / Webinars, Lending / Finance, Interviews / Speeches

| ALL

| ALL

What is a Deferred Sales Trust

If you are considering the sale of a highly-appreciated asset – business, corporation, or investment in real estate – you may face capital gains taxes associated with this transaction. A Deferred Sales Trust (DST) is a legal contract between you and a third-party trust in which you sell an asset to the Trust in exchange for the Deferred Sales Trust’s contractual promise to pay you a fixed sum over a prearranged future period in the form of an installment sale note or promissory note. A DST gives you the ability to control your capital gains tax exposure, reinvestment terms, and installment payments made from the Trust.

3 Common Uses for a DST. 1) Business Exit Strategy 2) 1031 Exchange Alternative 3) 1031 Rescue

Reef Point / Deferred Sales Trust | Date Uploaded: April 08, 2022

| Date Created: November 01, 2021| Commercial Properties for Sale, Lending / Finance, Tax Services/Accounting, Marketing/PR

| ALL

| ALL

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our official interview show. Joining us today is our Guest Joseph Fan President of Brighton Management and we are talking Hotels, Labor, Construction, PIP's the California Hotel Market and so much more.... Please tour our website at cliconference.com. If you would like to be a Production Partner or a Guest DM us and please subscribe, follow/like us and smash the bell for updates right here on YouTube, LinkedIn, Twitter, Facebook, IG, Spotify and audio podcasts on Google, Anchor, Apple and other platforms. Thank you.....

[CLIC] | Date Uploaded: April 07, 2022

| Date Created: April 07, 2022| Interviews / Speeches

| Hospitality, Multifamily

| CALIFORNIA

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our official interview show. Joining us today is our Guest Joseph Fan President of Brighton Management and we are talking Hotels, Labor, Construction, PIP's the California Hotel Market and so much more.... Please tour our website at cliconference.com. If you would like to be a Production Partner or a Guest DM us and please subscribe, follow/like us and smash the bell for updates right here on YouTube, LinkedIn, Twitter, Facebook, IG, Spotify and audio podcasts on Google, Anchor, Apple and other platforms. Thank you.....

[CLIC] | Date Uploaded: April 07, 2022

| Date Created: April 07, 2022| Construction, Development/Planning/Entitlements, Lending / Finance, Property Management, Interviews / Speeches

| Hospitality, Multifamily

| ALL

Commercial Real Estate & Lending Conference on April 26, 2022 will be held at the Sheraton Universal Hotel in Hollywood LIVE and In-Person. Featuring the trademarked LoanMakers Forum and DealSavers. Introducing a new way to Network with FOCUS NETWORKING. This is the most INTERACTIVE Commercial Real Estate event. Go to www.crelc.com for more information use discount code "review"

All Star Group | Date Uploaded: April 07, 2022

| Date Created: April 07, 2022| Events / Webinars, Lending / Finance, Marketing/PR

| ALL

| CALIFORNIA

Charles and Dalton from DMG, Inc. reveal deferred conditions on a commercial real estate industrial building that sometimes people don't know anything about. This segment is why overspray onto window systems is no good.

DMG | Date Uploaded: April 07, 2022

| Date Created: March 09, 2022| Property Management, Property Services/Inspections, Marketing/PR

| Industrial

| ALL

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our official interview show. Join the conversation today is our Guest Mark Crisci

Chief Investment Officer & Principal of Azul Hospitality Group and we are talking Hotels, F&B, Team, the California Hotel Market and so much more... Please tour our website at cliconference.com. Please subscribe, like/follow and smash the bell for updates right here on YouTube, LinkedIn, The REview, Twitter Facebook, IG Spotify and for audio podcast go to Anchor, Apple, Google and other platforms.... If you would like to be a Production Partner or a Guest DM us. Thank you.....

[CLIC] | Date Uploaded: April 05, 2022

| Date Created: April 05, 2022| Development/Planning/Entitlements, Tenant Concepts, Marketing/PR, Interviews / Speeches

| Hospitality, Restaurant

| ALL

Jim Costello with Real Capital Analytics shares his views on the office market, including cap rates, impact of covid, hybrid work, and rising interest rates.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: April 04, 2022

| Date Created: February 18, 2022| Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance, REITs / Investment Funds, Interviews / Speeches

| Office

| ALL

How will rising interest rates and inflation impact single tenant net lease property values? Nancy Miller with Bull Realty shares cap rate trends, financing update, and strategies.

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: April 04, 2022

| Date Created: February 15, 2022| Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance, REITs / Investment Funds

| Retail, Restaurant

| ALL

Watch the highlights from CrowdStreet’s investor sentiment survey including favored sectors and locations. Co-Founder Darren Powderly also shares the latest on sponsor equity options in the current market.

View the reports at:

2022 Investor Benchmark Survey - CrowdStreet https://bit.ly/3uQQOnw

2022 Best Places To Invest - CrowdStreet https://bit.ly/3HNhjhr

Learn more at https://www.crowdstreet.com/to-get-st...

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: April 04, 2022

| Date Created: February 11, 2022| Residential Properties for Lease, Residential Properties for Sale, Economics/Market Reports/Research, REITs / Investment Funds, Interviews / Speeches

| Industrial, Residential, Multifamily, Office, Retail, ALL

| ALL

This All Star Net Lease panel included Chris Marabella of Net Lease TV and Marabella Commercial Finance, Inc. (Moderator), Ted Dowding of TD Commercial Group and www.netleaseworld.com, Keith Sturm of Upland Real Estate and Evan Lyons of Tolson, Enterprises. The panel discusses the current 10 year treasury yield, 1031 LOI and buying strategies, Ukraine / Russia War and pros and cons for Net Lease. Chris Marabella discusses the Walgreens he most recently arranged a refinance for a repeat client he worked with in the last couple of months.

If you have an idea for Net Lease TV email or call Chris Marabella at nnn@marabellafinance.com and cell is (760) 803-6464.

Net Lease TV | Date Uploaded: April 02, 2022

| Date Created: March 11, 2022| Commercial Properties for Sale, Brokerage, Development/Planning/Entitlements, Events / Webinars, Lending / Finance

| Retail, Restaurant

| ALL

In this episode of Net Lease TV we interview Urszula Zoltek about her New Jersey Ground Lease property that she represented 7-Eleven and the Landlord / Developer to put this project together.

Coming Soon!!!

Zoltek Commercial Real Estate Services is pleased to announce a fully approved corporate 7-ELEVEN Convenience Store with Full-Service Gas Station coming soon to E. Hanover Ave in Cedar Knolls, New Jersey!

Urszula Zoltek of Zoltek CRES represented both, the tenant and the landlord. Congratulations and special thanks to 7- ELEVEN, Doug Bomzer, Stuart Kimmel, @JMF Properties, and everyone involved!

For ideas for future episodes of Net Lease TV text or email Chris Marabella at Cell (760) 803-6464 and email is nnn@marabellafinance.com

Net Lease TV | Date Uploaded: April 02, 2022

| Date Created: March 20, 2022| Commercial Properties for Sale, Brokerage, Development/Planning/Entitlements, Lending / Finance, Interviews / Speeches

| Retail, Restaurant

| ALL

n this video feed Chris Marabella MCF interviews Ralph Cram of Envoy who can offer 100% of cost construction financing for single tenant Net Lease properties in conjunction with Marabella Commercial Finance. For additional info on this interview call Chris Marabella at (760) 479-0800.

For additional ideas for future Net Lease TV episodes email Chris Marabella at nnn@marabellafinance.com. To subscribe to Net Lease TV click on the link below;

https://www.marabellafinance.com/net-...

Net Lease TV | Date Uploaded: April 02, 2022

| Date Created: April 02, 2022| Commercial Properties for Sale, Construction, Development/Planning/Entitlements, Lending / Finance, Tenant Concepts

| Retail, ALL, Automotive, Restaurant

| ALL

In this episode of Net Lease TV on Tour Chris visits a newly remodled retail building that was previously a Fry's Electronics and was re-tenanted with a Costco Office Wholesale. Costco owns the building and entered into a Ground Lease with the previous owner of the Land. This Costco is located at;

Costco Office

150 Bent Avenue

San Marcos, CA

If you would like to contact Chris Marabella regarding this episode or financing for a Costco or other net lease property his cell phone to call or text is (760) 803-6464. Or he can meet you on a Go To Meeting / Call or at one of his many offices located in Beverly Hills, Costa Mesa, Carlsbad and San Diego. For more Net Lease TV and to become a Patron or Subscribe click on the link below;

https://www.marabellafinance.com/net-...

Net Lease TV | Date Uploaded: April 02, 2022

| Date Created: April 02, 2022| Economics/Market Reports/Research, Lending / Finance, News, Tenant Concepts, Interviews / Speeches

| Retail, Restaurant

| CALIFORNIA

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our interview show with todays industry leaders. Joining the conversation today is Ryan Huntsman, VP Chicago Title NCS California. We are talking Hotels, Deals, Closing On Time, Team, Policies, The rise of the Motique and so much more.... Please tour our website at cliconference.com.

[CLIC] | Date Uploaded: March 31, 2022

| Date Created: March 31, 2022| Title/Escrow/Closing, Interviews / Speeches

| Hospitality, ALL

| ALL

It's Tuesday..... Producer Danyetta Leffler and I are back with a new episode of [CLIC] Connect..... Joining us today is Vinay Patel, Chairman of AAHOA and we are talkin Hotels, AAHOA, [CLIC] 5 & the Hunter Conference and AAHOACON and so much more.... Please tour our website at cliconference.com. Thank you to our Production Partners Radisson Hotel Group & Chicago Title NCS California and if you would like to be a Production Partner or a Guest please DM Producer Dani or myself.

[CLIC] | Date Uploaded: March 29, 2022

| Date Created: March 29, 2022| Development/Planning/Entitlements, Economics/Market Reports/Research, Events / Webinars, Marketing/PR, Trade Groups, Interviews / Speeches

| Hospitality

| ALL

[CLIC] is the only Hotel Conference that focusses on the California Hotel Market and [CLIC] Connect is our interview show. Joining us today is Chris Daly of Daly Gray Public Relations and we are talking PR for Hotels/Hospitality, Messaging, Communication, Hotels, Glenn Haussman & Bruce Ford. Note: Daly Gray is the [CLIC] public relations firm we are working with. Please tour our website at cliconference.com.

[CLIC] | Date Uploaded: March 26, 2022

| Date Created: March 26, 2022| Marketing/PR, Interviews / Speeches

| Hospitality

| ALL

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our interview show. Joining us today is the one and only Ms. Sarah Dandashy a Travel Expert + Content Creator + Hospitality Author to mention a few.... We are talk about Sarah's new book, Travel, Hotels and so much more..... Please tour our website at cliconference.com. Thank you Sarah it is always a pleasure having you on [CLIC] Connect. Smash that bell and follow us right here on YouTube on the California Lodging Investment Conference Channel.

[CLIC] | Date Uploaded: March 26, 2022

| Date Created: March 26, 2022| Marketing/PR, Interviews / Speeches

| Hospitality

| ALL

In the final episode of our #coffeebreak series, #TW’s Mark Stratz describes how Ilume’s proximity to local and state universities and the Mayo Clinic will create collaboration and partnerships in the #lifesciences community.

Transwestern | Date Uploaded: March 24, 2022

| Date Created: March 24, 2022| Commercial Properties for Lease, Interior Design, Neighborhoods/Communities/Cities, Tenant Concepts, Marketing/PR

| Office, Bio-Technology / Laboratory, Life-Science

| ARIZONA

110-person auditorium, rooftop park, and fitness center, to name a few, the newly renovated life sciences Ilume building offers a lifestyle to its tenants and users.

Check out episode 3 of the coffee break series...

Transwestern | Date Uploaded: March 17, 2022

| Date Created: | Commercial Properties for Lease, Architecture, Interior Design, Landscaping, Property Management, Marketing/PR

| Office

| ARIZONA

For Sale - Small Industrial Building in Northridge, CA. Clear-span building with no interior roof supports or interior bearing walls. Contact Jason Schwetz at jason@jdsrealestate.com

JDS Real Estate | Date Uploaded: March 14, 2022

| Date Created: March 01, 2022| Commercial Properties for Sale

| Industrial

| CALIFORNIA

Michael does a show once a year for the brokerage community. This year he shares the top ten strategies for success for commercial brokers. If you are not an agent, or do not work with agents, this show might be boring...but if you are an agent or work with agents, it’s pure gold! Part 2

Watch part 1 here: https://youtu.be/wJvpUlLRl9Q

Brought to you by:

Bull Realty - https://www.bullrealty.com/

Commercial Agent Success Strategies - https://www.commercialagentsuccess.com/

Buxton - https://www.buxtonco.com/

America's Commercial Real Estate Show | Date Uploaded: March 10, 2022

| Date Created: February 04, 2022| Brokerage, Educational Programs

| Industrial, Multifamily, Office, Retail, ALL

| ALL

Welcome to the Empire State Building! Iconic to New York City’s skyline, we visit the people who have aided in this building standing the test of time. Anthony Malkin, CEO of Empire State Realty Trust kicks us off diving into the fundamentals of how ESB has evolved since it’s erection in 1931 to now navigating the challenging waters of the Coronavirus pandemic. We learn that the Empire State Building is one of the most efficient and healthy buildings in the world. Then, up on the 102nd floor of the building we chat with Dana Schneider, Head of Sustainability for ESRT who talks us through the buildings tech stack and sustainability journey. Before ending our trip we check out the observatory with Jean-Yves Ghazi, President of ESB Observatory. The Observatory has recently had an impressive revamp with experience at the forefront.

Next we dissect the smart glass skyscraper with smart glass innovator, View Inc. With the ability to transform the entire facade of a building, View Inc, is a game changer in the world of supertalls. From controlling the indoor climate by either limiting or inviting sunlight into the space, to blocking uv rays and now transforming the glass itself into a screen display, this material can do it all. What does the future of supertalls look like? View Inc. just might have the answer.

After visiting supertalls in Manhattan, we pack our bags and road trip up to Goshen, New York to meet up with Falconer Tom JV Cullen IV. Falconry is the art of training and using a raptor to hunt quarry for sport and what most people don’t realize is that New York City has the highest population of Peregrin Falcons in the world. Making their homes in the crowns of supertall buildings and bridges of the city, these birds of prey are an integral part of the city ecosystem.

JLL TV | Date Uploaded: March 09, 2022

| Date Created: February 09, 2022| Architecture, Development/Planning/Entitlements, Interior Design, Property Management, ESG (Environmental, Social and Governance)

| Office

| NEW YORK

[CLIC] is the only Hotel Conference that focuses on the California Hotel Market and [CLIC] Connect is our interview show. Joining us today is our Guest Andrea Depew of iig Design. We are talking Hotels Interior Image Group, Brands, Adaptive Reuse, Trends, Design and so much more..... Join us on March 10th, 2022 for [CLIC] 5. Please tour our website at cliconference.com details and registration.

[CLIC] | Date Uploaded: March 03, 2022

| Date Created: March 03, 2022| Construction, Interior Design, Property Management, Marketing/PR, Interviews / Speeches

| Hospitality

| ALL

Fully Stabilized and renovated one story commercial property consisting of 3 retail and office tenants.

The Laundromat was there for over 25 years, recently went through gut renovation.

Tri State Commercial Realty | Date Uploaded: March 03, 2022

| Date Created: March 03, 2022| Commercial Properties for Sale

| Retail

| NEW YORK

The Ilume was built with all of the necessary elements for GMP manufacturing and general and focused research for a #lifesciences user.

When Stockdale acquired the building, one of their biggest concerns was who could help them understand the Life Sciences market? Watch episode 2 of our #coffeebreak series, as Stockdale’s Andrew Saba explains.

Transwestern | Date Uploaded: March 02, 2022

| Date Created: March 02, 2022| Commercial Properties for Lease, Architecture, Interior Design, Property Management, Marketing/PR

| Office, Bio-Technology / Laboratory, Life-Science

| ARIZONA

Angela and Paul from DMG talk about crazy challenges acquiring documentation for Phase 1 reports.

DMG | Date Uploaded: March 01, 2022

| Date Created: | Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

Did you know depending on the level of exposure, Lead can adversely affect the nervous system, kidney function, immune system, reproductive and developmental systems, and cardiovascular system. Paul and Angela to talk more about Lead and how to handle it!

DMG | Date Uploaded: March 01, 2022

| Date Created: February 16, 2022| Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

Did you know that Asbestos can cause serious health issues? Paul Dubone and Angela Todd of DMG discuss how they identify Asbestos in a Phase I environmental site assessment and how Asbestos has many health risks like shortness of breath, coughing, and permanent lung damage.

DMG | Date Uploaded: March 01, 2022

| Date Created: February 09, 2022| Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

Meet Paul Dubone, our Phase 1 Environmental Specialist together with Angela, he's here to explain what moisture-stained ceiling tiles are, what are its causes and what will happen if you don't take care of them.

DMG | Date Uploaded: March 01, 2022

| Date Created: February 02, 2022| Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

Angela and Paisley explains why we need Proper Access when accessing your property.

DMG | Date Uploaded: March 01, 2022

| Date Created: January 21, 2022| Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

Roof Access Failure =#PTSD!

DMG | Date Uploaded: March 01, 2022

| Date Created: January 19, 2022| Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

Angela Todd of DMG explains the benefits of a Phase I Environmental Site Assessment during a commercial real estate escrow transaction.

DMG | Date Uploaded: March 01, 2022

| Date Created: January 05, 2022| Property Management, Property Services/Inspections

| Residential, Office, Mixed-Use: Office / Retail, Mixed-Use: Multifamily / Retail, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail, Mixed-Use: Multifamily / Office

| ALL

.jpg)

of Untitled design-High-Quality (1).jpg)

of Untitled design-High-Quality (1).jpg)