VIDEO SEARCH

2153 videos found

What's happening with the retail real estate market in greater Boston, Massachusetts? In this video, Jeremy Cyrier explains Mid Q4 2019 retail property sales and rental rate information for Rockingham, Essex, and Middlesex counties covering north and west of Boston into southern New Hampshire.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

Get an industrial market update for greater Boston:

https://www.youtube.com/watch?v=esCE1...

Get an office market update for greater Boston: https://www.youtube.com/watch?v=uibdJ...

Find out the top 5 questions to ask your commercial real estate broker: https://masscommercialproperties.com/...

So, how's the retail market? I get that question quite a bit and it's a great question. If you read the news, all you're hearing about are big-box stores, department stores, and the Amazon effect.

But what's interesting about retail, particularly in the market that we track, which is the 1 to $20 million market for Rockingham, Essex and Middlesex counties, is that this market isn't necessarily following what you're seeing in the news. In fact, what we're seeing is continued appreciation. In fact, the average price per square foot for retail property, between 1 and 20 million, is currently trading at $221 a square foot. It's continued to appreciate, as have rents, from quarter four 2010 to quarter four 2019. The average rents for retail space are $23.20 a square foot. That's up 15.39% over the last nine years.

So, we're continuing to see appreciation in retail and we're continuing to see investors have appetite for retail, but what we are seeing is velocity slowing down a little bit. So, what I mean by that is that while prices are appreciating, the number of buildings that are trading by year are slowing a bit. In 2018, there were 59 more trades than there should be by the end of 2019. That's based on the annualized information that we project, following the activity in the market.

The vacancy rates are at 2.8%. Very low. This is 137 million square foot market. There's a lot of retail in the market. We are seeing a downtick in availability. So, what that means is that landlords aren't anticipating space coming back. But we are seeing some rental depreciation, so rents are are turning a little bit.

The Glenn Mueller market cycle chart shows us at peak for retail in our greater Boston MSA, as you can see here. So, definitely seeing signs of continued health and exuberance in the market. How long it'll go for, I don't know, but we are seeing a slight cooling in volume.

If you like getting these market updates, please subscribe to our channel. We look forward to getting you the next one. Thanks.

MANSARD | Date Uploaded: July 29, 2021

| Date Created: November 15, 2019| Commercial Properties for Lease, Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Retail

| MASSACHUSETTS

We all want to know what's happening with the Woburn industrial space market. What's sold this year? How much are Woburn industrial buildings selling for? And what's going on with rental rates in Woburn, Massachusetts? In this video, Jeremy Cyrier, CCIM walks through 2019 Woburn industrial space market data so you can sell your Woburn industrial property with confidence.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

Links we're sharing with you to new PDF reports:

Top 5 questions to ask your commercial real estate broker: https://masscommercialproperties.com/...

Get your Woburn industrial property valued by an expert: https://masscommercialproperties.com/...

The best way to sell industrial property: https://masscommercialproperties.com/...

So what's going on with the Woburn industrial market just outside of Boston? Well, that's a great question. So we help owners of high value commercial properties sell their assets to the right buyer for the right price so they can sell with confidence. So one of the things we've done is we've gone back and looked at the Woburn market over the last 12 months and Woburn, with its position located at the intersection of 93 and 95, is ideally located to service a lot of industrial requirements from warehouse distribution, Flex/R&D. So what's going on there? Well, this 13.7 million square foot market has actually been pretty quiet over the last 12 months. In fact, there have been only a few trades. There was a large to $230 million portfolio that traded, which was net lease to Harvey Building Products. That portfolio was located throughout New England and Pennsylvania with three of the properties on Commonwealth drive in Woburn. So that's sort of an outlier in terms of what the local market's doing.

What we do see is the local markets performing in a very tight and constricted way. In fact, there's not a lot of inventory trading. What we're seeing in CoStar is a 2.7% vacancy rate. And with the few trades that are happening in the market, what this is telling us is that most owners are holding their assets. They're not selling these buildings. There's a high demand for them. The average price per square foot is running about $133 for industrial and Flex. And CoStar's reporting a cap rate of 6.9% with average rental rates at $14.32. So typically what we see in a market like this where owners are looking at and appreciating upward trend, they will hold unless there's a reason to sell.

So as a result of that, we're seeing an upward pressure on pricing for these buildings. We're seeing upward pressure on rent for these properties. And there's really not a lot of room here in the market to build any new product. So it's constricted, it's tight. We have seen the trades that are occurring over the last 12 months at 20 Sonar. That sold for 136 bucks a square foot. 11 Wheeling is traded at 118 a square foot. 1 Walnut Hill at 116 a foot. And 79 Pine at $85 a square foot.

So if you have other questions about what's happening in the Woburn market and when this market might open up for more opportunities to take advantage of these market trends, feel free to reach out. We're available for consultations. But in the meantime, if you like what you're getting here, please subscribe to our channel for more market updates. Thank you.

MANSARD | Date Uploaded: July 29, 2021

| Date Created: November 15, 2019| Commercial Properties for Sale, Brokerage, Economics/Market Reports/Research

| Industrial

| MASSACHUSETTS

We all want to know what's happening with Wilmington MA industrial property sales trends. That way we can make the best real estate decisions at the right time in the market. In this video, Jeremy Cyrier, CCIM provides an update on 2019 Wilmington MA industrial property sales trends.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

The best way to sell commercial real estate for the right price: https://masscommercialproperties.com/...

The top 5 questions to ask your commercial real estate broker: https://masscommercialproperties.com/...

Woburn industrial space market stats: https://masscommercialproperties.com/...

What’s going on with the Wilmington MA industrial sales trends market?

Owners of high-value commercial real estate come to us when they’re having difficulty finding the right buyers so they can sell with confidence. So what’s going on in Wilmington? Well, Wilmington’s been a much more active markets and the Woburn market has. In fact, Wilmington tends to be a spillover market from its sibling Woburn.

Wilmington Industrial Property Market Stats: 2019

What we’re seeing in this 9.8 million square foot industrial flex market, is an average transaction value in 2019, of $119 a square foot. CoStar’s reporting cap rates in this market at 6.9%, and rents are averaging $11 and 98 cents a square foot. Vacancy rate’s running 6.2% which is much higher than Woburn, which is currently at about 2.7%. so what does this tell us? What this tells us is that Wilmington often tends to be a spillover market from Woburn in the three zones in Wilmington that you see having spillover. The 38 corridor, the 129 exit at 93, as well as Concord street, and then the Ballardvale section of Wilmington.

Wilmington Outsells Woburn in 2019

So some of the recent transactions that are pushing the values, the highest one on record this year is 300 Ballardvale, which was the Monogram Foods acquisition. That building traded at 300 Ballardvale for $213 a square foot. That was followed by the sale of three Jonspin Road properties, 46 53 and 55 Jonspin, at $145 a square foot. And then 44 Concord street at 147.50 a square foot. Wilmington Technology Park, that portfolio of four buildings, that traded for $133 a square foot.

So overall Wilmington, much more active market on the sales side in 2019 than its sibling market, Woburn. And we’ll see what 2020 has in store. So if you’re interested in receiving market updates, subscribe to our channel and we’ll talk to you soon. Thanks.

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial

| MASSACHUSETTS

Sales trends to watch in the North Reading, MA industrial real estate market -- in this video Jeremy Cyrier, CCIM briefs us on 2019's most notable industrial real estate sale as well as rental rate and vacancy trends.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

The best way to sell commercial real estate for the right price: https://masscommercialproperties.com/...

The top 5 questions to ask your commercial real estate broker: https://masscommercialproperties.com/...

Woburn industrial space market stats: https://masscommercialproperties.com/...

So, how was the North Reading industrial market in 2019? Once we wrapped up the year, North Reading is a relatively small market. It's about 1.7 million square feet of industrial and flex property. There's not a whole lot going on there, but the market dynamics are very positive because of the short supply and its strategic location to 93. So, at MANSARD, what we do here is we help owners of high value industrial and flex properties in North Reading find the right buyers who perform so that you can sell your property with confidence.

So, in this market in 2019 the average price per square foot came in at $139 per square foot. So, that's a rich price for industrial and flex in this market. It exceeds the average price per square foot for industrial and flex throughout the Rockingham Essex and Middlesex County markets. CoStar reports the average cap rate in North Reading has been 7.2% in 2019 and the average rental rate has been trading around $13.98 a square foot.

Virtually a fully occupied market. There's hardly any vacancy in North Reading, and what we've seen in the market is anything that does come available tends to move very quickly. The most notable sale of the year was 217 R Main Street in North Reading. That building sold for $3.6 million or $105 a square foot. If you'd like more information about what's happening in North Reading, please feel free to reach out or you can subscribe here to our market updates. Look forward to seeing you again. Thank you.

MANSARD | Date Uploaded: July 29, 2021

| Date Created: December 31, 2019| Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial

| MASSACHUSETTS

What's happening in the Cambridge industrial and flex market in 2019-2020? In this video Jeremy Cyrier, CCIM delivers a brief update on the state of the market, recent sales trends, pricing, cap rates, and rental rates.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

The best way to sell commercial real estate for the right price: https://masscommercialproperties.com/...

The top 5 questions to ask your commercial real estate broker: https://masscommercialproperties.com/...

Woburn industrial space market stats: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial

| MASSACHUSETTS

Here's a hint: your commercial property buyer probably already owns a similar property in your area. Studies show that people who own similar property to the one you're selling are more likely to agree with your price and perform.

Sales trends to watch in the Boston commercial real estate market: https://masscommercialproperties.com/...

The best way to sell commercial real estate for the right price: https://masscommercialproperties.com/...

The top 5 questions to ask your commercial real estate broker: https://masscommercialproperties.com/...

Woburn industrial space market stats: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale, Brokerage

| Industrial, Office, ALL

Access the Q1- 2020 PDF market report: https://mansard.lpages.co/market-repo...

How's the market? In this video, you'll learn how Q1 - 2020 started and how the COVID-19 shutdown is affecting commercial real estate sales transactions. The data covers office, industrial, retail, and flex properties valued between $1M - $20M in Rockingham, Middlesex, and Essex Counties.

--------------------

Like what you see? Go to: https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale, Economics/Market Reports/Research

| Industrial, Office, Retail, ALL

| MASSACHUSETTS

In this video, watch a data-driven update on the Greater Boston commercial real estate sales trends to watch. Today, we cover what's happening in the second quarter of 2020 in the Rockingham, Essex, and Middlesex county markets for office, retail, and industrial properties.

Download our PDF market report at https://masscommercialproperties.com/...

Discover your commercial property valuation: https://masscommercialproperties.com/...

Some people are asking "will commercial real estate crash?": https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale

| Industrial, Office, Retail, ALL

| MASSACHUSETTS

95 Billerica Avenue is a 74,031 SF Flex property that is 100% leased to Aved Electronics (A Lithion Company) and Cristek Interconnects -- two world-class contract manufacturers. The property features a newly installed freight lift along with a renovated, two-story atrium, lobby, brand new second story floor windows installed in 2020, two tailboard loading docks, and abundant employee parking. The second floor has been built out to accommodate Aved's expansion, leased to Aved at a below-market rental rate, as well as Cristek's new growth. The property offers a weighted average lease term of 6 years with a net operating income of $672,430 with 15% contractual NOI growth over the lease term.

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale

| Industrial, Mixed-Use: Industrial / Office

| MASSACHUSETTS

Making the decision to sell your commercial property involves a thoughtful analysis of the pros and cons of doing so.

That decision is only made easier by working with an astute and experienced commercial property broker who is an expert in high-value commercial property sales. Through their expertise, you will get the high value offer you want and maximize the return on your investment. Sell your commercial property with confidence with MANSARD. Contact us, and we’ll discuss what makes your commercial property unique.

Contact MANSARD at (617) 674-2043 • advisors@mansardcre.com

https://masscommercialproperties.com/...

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale, Brokerage, Marketing/PR

| Office, ALL

| MASSACHUSETTS

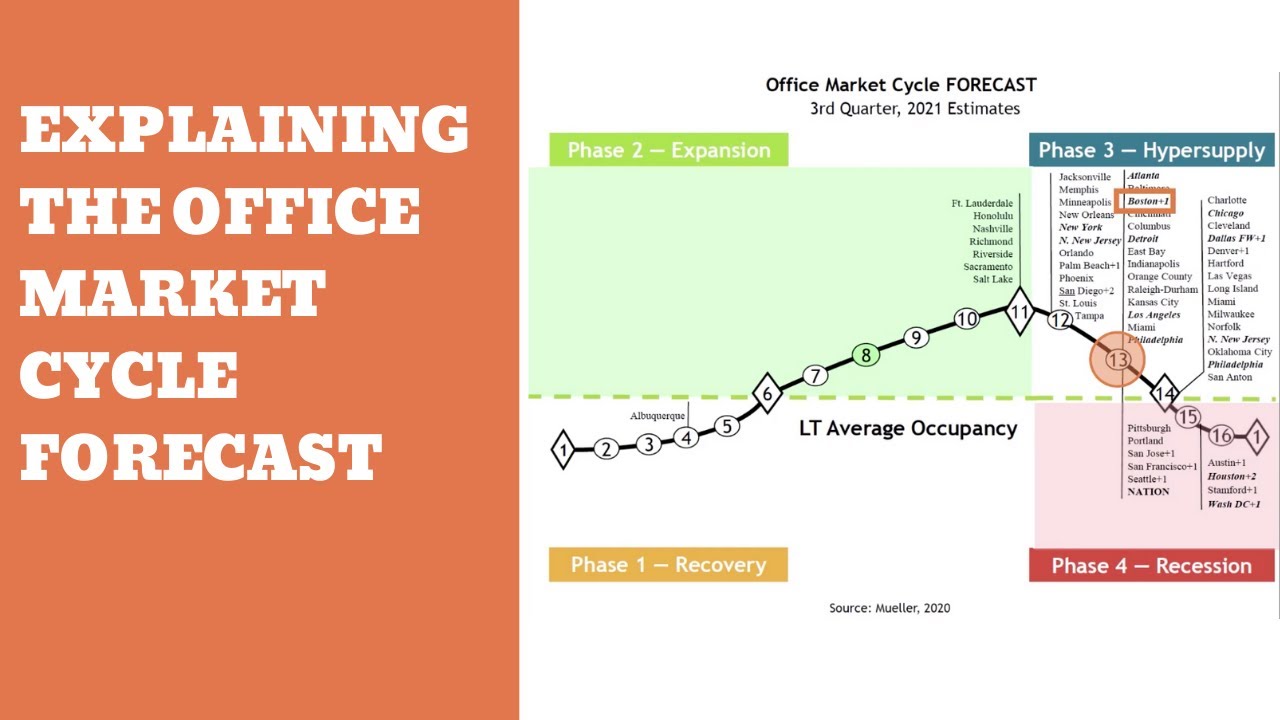

The four quadrants of the market cycle include:

Recovery Phase

Expansion Phase

Hyper Supply Phase

Recession Phase

Contact MANSARD today at (617) 674-2043 • advisors@mansardcre.com

Visit us at masscommercialproperties.com

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Economics/Market Reports/Research

| Office, ALL

| ALL

Contact MANSARD today at (617) 674-2043 • advisors@mansardcre.com

Visit us at masscommercialproperties.com

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale, Economics/Market Reports/Research

| Office

| MASSACHUSETTS

Contact MANSARD today at (617) 674-2043 • advisors@mansardcre.com

Visit us at masscommercialproperties.com

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale

| Industrial

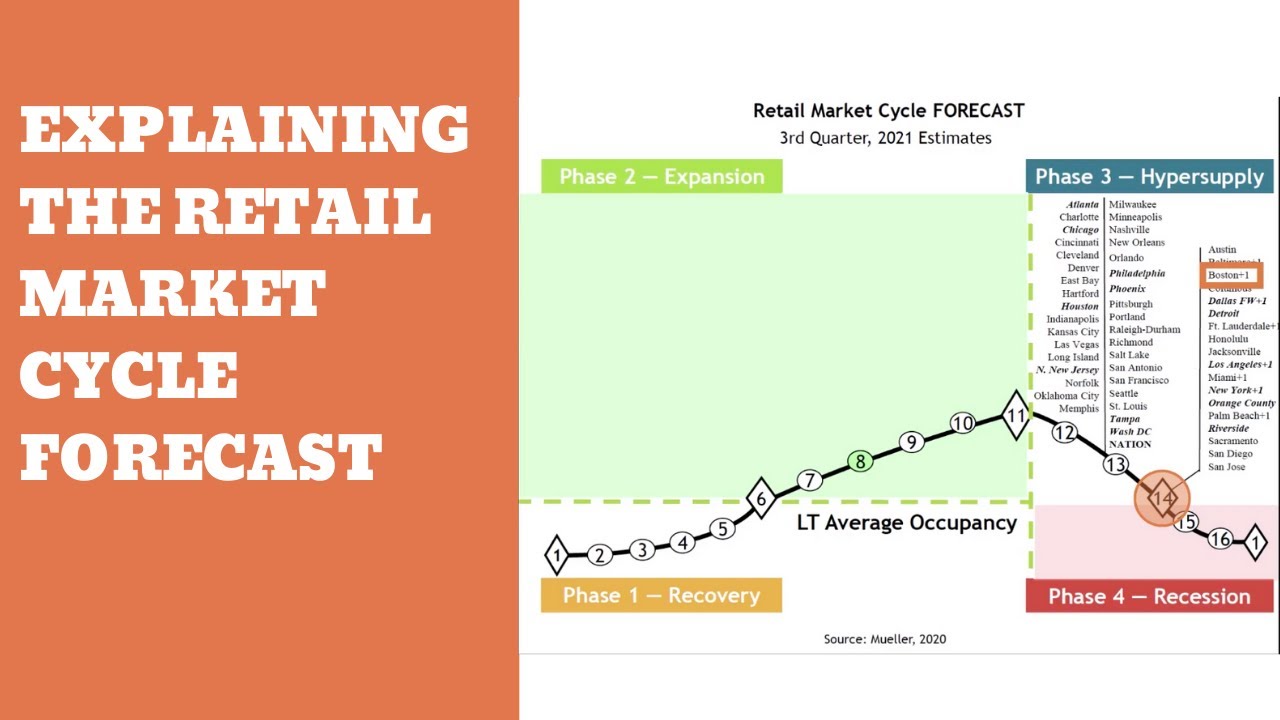

A 3rd Quarter, 2021 look into retail.

Contact MANSARD today at (617) 674-2043 • advisors@mansardcre.com

Visit us at masscommercialproperties.com

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale

| Retail

Contact MANSARD today at (617) 674-2043 • advisors@mansardcre.com

Visit us at masscommercialproperties.com

MANSARD | Date Uploaded: July 29, 2021

| Date Created: | Commercial Properties for Sale

After eight cash offers in 18 days, this industrial building outsold its peers by $250,000. Dependable Masonry, the 40-year owner of 73 Concord Street, retired from the property.

Each year, they spent $35,000 in taxes, insurance, and maintenance, struggled with management, and ultimately faced a capital gains tax bill of nearly $400,000 upon sale. They reinvested their profits in property leased by a New York Stock Exchange-traded company, paying him $100,000/year in net cash flow until 2032. Their new tenant manages, pays the tax bill, and maintains the building.

Here's how it happened.

In-depth market data and market cycle analysis showed that the industrial market's expansion would pay off for Dependable. Once they realized the time was right to capture maximum pricing, they agreed to follow our pricing guidance. Our market research revealed that 8.2% of the industrial buyers in the area would purchase and use similar properties for their own business.

Also, the property should be offered to the brokerage community so that any brokers representing high-intent buyers would bring them to Dependable Masonry. Ten days after launching the MANSARD proprietary marketing process, Dependable Masonry received eight offers, hosted 18 tours, and followed our negotiation advice to reach an agreement.

Once the offer was accepted, Dependable Masonry's legal and tax team wrapped up the tax planning. That's when they decided to pursue a 1031 strategy to save nearly $400,000 in capital gains taxes. After six weeks of investment review meetings, Dependable Masonry selected the top investment opportunity -- a Dollar General, an NYSE-traded company, with 12 years remaining on its initial lease term.

The 1031 exchange allowed Dependable Masonry to save the capital gains taxes and start generating $100,000/year in free cash flow 45 days after the sale of their headquarters.

We love to see our clients win. Want to see how to sell your property with confidence and reinvest the proceeds for increased cash flow and fewer headaches? Request your consultation today.

When you reach out to us, we'll schedule a discovery call. We want to know everything about your property and your goals so we can match you with the right buyer who will pay the most, close on time, and keep issues in check to get the deal done.

Next, we will create a thorough plan to sell your property and share it with you. We market your property until the day of the closing. You're never in the dark with MANSARD.

To help you make a smart deal, we'll keep you informed while we aggressively market your property using our 42-point proprietary sales process. 88.9% of MANSARD deals close on time at the seller's accepted offer price. That means less hassle, lower stress, and more celebrating.

Request your consultation today. Click here: https://Mansard.as.me/

MANSARD | Date Uploaded: July 27, 2021

| Date Created: | Commercial Properties for Sale, Brokerage, Marketing/PR

| Industrial

| MASSACHUSETTS

100% leased Class "A" office building in Las Vegas, NV for sale.

Cushman & Wakefield - Marlene Fujita | Date Uploaded: July 27, 2021

| Date Created: | Commercial Properties for Sale

| Office

| NEVADA

This video sharea the mantra of Turnbull Capital Group - that we are empathetic team players in supporting the hospitality industry in providing creative equity and debt solutions to assist hotel and resort owners and operators in making it through the aftermath of this black swan event. Turnbull Capital Group Newport Beach California 92660

Turnbull Capital Group | Date Uploaded: July 26, 2021

| Date Created: | Lending / Finance, Marketing/PR

| Hospitality

| ALL

This video shares the history of our 31 years of selling and financing distressed hotels and resorts - our fifth rodeo in the distressed space - having been involved in in excess of $19.5 billion of distressed hotels and resorts. We have been pioneers in the execution of preferred equity to assist distressed hotel and resort owners and operators.

Turnbull Capital Group | Date Uploaded: July 26, 2021

| Date Created: | Commercial Properties for Sale, Economics/Market Reports/Research, Lending / Finance

| Hospitality

| ALL

This video shares the history of our philanthropic endeavors going back to 1994. We have been involved in ten different 501(c)3s over the last 27 years from assisting homeless veterans and homeless women and children - but primarily supporting the environment and protecting both the Pacific Ocean and Santa Catalina Island. Turnbull Capital Group Newport Beach California 92660

Turnbull Capital Group | Date Uploaded: July 26, 2021

| Date Created: | Charities, Lending / Finance, ESG (Environmental, Social and Governance), Marketing/PR

| Hospitality

| ALL

Turnbull Capital Group Newport Beach California 92660 . This video will share the skeletal history of Turnbull Capital Group in Newport Beach, California. We have been financing and selling hotels for 36 years: 20 years with CB Richard Ellis as the Founder of CBRE Hotels and 3 years with what is now Walker & Dunlop as the Founder of the hospitality lending practice.

Turnbull Capital Group | Date Uploaded: July 26, 2021

| Date Created: | Lending / Finance, Marketing/PR

| Hospitality

| ALL

As the economy heats up and demand remains strong for raw materials, are manufacturers expanding their operations to meet the need? John Ferruzzo weighs in on this episode of Coffee Break.

Transwestern | Date Uploaded: July 23, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Lending / Finance, REITs / Investment Funds

| Industrial, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail

| ALL

How are Crane-Served Projects Performing?

With a favorable interest rate market, crane-served industrial projects are seeing tenants become owners. Hear more from niche expert, John Ferruzzo on this episode of Coffee Break.

Transwestern | Date Uploaded: July 23, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Lending / Finance, REITs / Investment Funds

| Industrial, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail

| ALL

How are Tenant Needs Impacting Industrial Projects?

Taller clear heights and higher parking ratios are being factored into new industrial builds. Is this being driven by tenant needs or by investors buying for the future? Industrial expert, Brian Gammill weighs in on this episode of Coffee Break.

Transwestern | Date Uploaded: July 23, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Construction, Lending / Finance, REITs / Investment Funds

| Industrial, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail

| ALL

Are New Tenants Driving Industrial Demand?

494.9 MSF of industrial space is under construction nationwide. Are there new industrial tenants to fill it? In this episode of Coffee Break, industrial expert Brian Gammill gives us a peek at what he’s seeing. Check out our 1Q National Industrial report for more insights.

Transwestern | Date Uploaded: July 23, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Construction, Development/Planning/Entitlements, Lending / Finance, REITs / Investment Funds

| Industrial, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail

| ALL

What is driving the Industrial Investment Market? Aside from the "Amazon effect" - what is driving the industrial market? Houston's Brian Gammill discusses the bond market and real estate allocations from domestic funds and sovereign capital in this edition of Coffee Break.

Transwestern | Date Uploaded: July 23, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Construction, Development/Planning/Entitlements, Lending / Finance, REITs / Investment Funds

| Industrial, Mixed-Use: Industrial / Office, Mixed-Use: Industrial / Retail

| ALL

In this recap, we discuss the consequences of Biden's proposed cap on 1031 exchanges on the real estate investment market. We also take a look at recent developments by Dollar General and 7-Eleven.

SUBSCRIBE to our newsletter to have the top stories hand-delivered to your inbox: https://mailchi.mp/avisonyoung/netleasenews_signup

FOLLOW us on social media:

Instagram: @netleasebeast

Twitter: @netleasebeast

Facebook: https://www.facebook.com/NetLeaseBeast

LinkedIn: https://www.linkedin.com/company/net-lease-beast

If we can help you with any of your real estate needs, please don't hesitate to reach out via email at landan.dory@avisonyoung.com or at 432-288-7162. For more information, please visit netleasebeast.com and avisonyoungnetlease.com.

Net Lease Beast - Landan Dory | Date Uploaded: July 20, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Brokerage, Lending / Finance, Tenant Concepts

| Hospitality, Retail, Other, Automotive, Restaurant

| ALL

In this weekly recap, we take a deeper look at the consequences of Biden's cap on 1031 exchanges on the STNL real estate investment market. Additionally, we discuss new developments regarding Jack in The Box and Applebee's.

SUBSCRIBE to our newsletter to have the top stories hand-delivered to your inbox: https://mailchi.mp/avisonyoung/netleasenews_signup

FOLLOW us on social media:

Instagram: @netleasebeast

Twitter: @netleasebeast

Facebook: https://www.facebook.com/NetLeaseBeast

LinkedIn: https://www.linkedin.com/company/net-lease-beast

If we can help you with any of your real estate needs, please don't hesitate to reach out via email at landan.dory@avisonyoung.com or at 432-288-7162. For more information, please visit netleasebeast.com and avisonyoungnetlease.com.

Net Lease Beast - Landan Dory | Date Uploaded: July 20, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Brokerage, Tenant Concepts

| Hospitality, Retail, Other, Restaurant

| ALL

The CRE Firm Hybrid model of how Technology improves human efficiency

Tri State Commercial Realty | Date Uploaded: July 20, 2021

| Date Created: | Brokerage, Technology / Proptech

| Multifamily, Office, Retail

| NEW YORK

Why did we expand specifically to Philly

Tri State Commercial Realty | Date Uploaded: July 20, 2021

| Date Created: | Brokerage, Neighborhoods/Communities/Cities, Marketing/PR

| Multifamily, Office, Retail

| PENNSYLVANIA

TSC Precision Recruiting Video May2021

Tri State Commercial Realty | Date Uploaded: July 20, 2021

| Date Created: | Brokerage, Marketing/PR

| Multifamily, Office, Retail

| PENNSYLVANIA

Shlomi Bagdadi on Tri State Commercial's Rise to a Brooklyn Powerhouse. Aril 28, 2021.

Tri State Commercial Realty | Date Uploaded: July 20, 2021

| Date Created: | Brokerage, Neighborhoods/Communities/Cities

| Multifamily, Office, Retail

| NEW YORK

Highlights:

- Lot size: 9,830 SF

- Building size: 7,521 SF

- Prime development opportunity on Broad St

- Just steps away from Passyunk Ave

- On-site parking available

1900 S Broad St, Philadelphia, PA 19145

Tri State Commercial Realty | Date Uploaded: July 20, 2021

| Date Created: | Commercial Properties for Sale, Development/Planning/Entitlements

| Land, Office

| PENNSYLVANIA

Slideshow of recent work completed by STREAMLINE BUILDERS INC., LOS ANGELES

General Contracting & Construction Management. As premium builders and trusted collaborators, we effectively execute every phase and detail of your project to deliver exceptional quality, beautification, and an excellent return on your investment. Since 2010, we’ve been proudly serving Southern California, from Long Beach to Ventura.

Streamline Builders | Date Uploaded: July 15, 2021

| Date Created: | Construction, Marketing/PR

| Multifamily

| CALIFORNIA

Project: Resurfacing of pool and multi-use rooftop decks overlooking DTLA. This resort-inspired rooftop pool and spa deck were completely renovated by Streamline Builders, Inc. of Santa Monica.

Streamline Builders | Date Uploaded: July 15, 2021

| Date Created: | Construction, Landscaping

| Multifamily

| CALIFORNIA

NoHo14 Multi-Family Remodel North Hollywood. This video is of a lobby renovation were we gutted it, added new wall paneling, flooring, new polished concrete floors, new business lounge upstairs and offices.

Created Dec 16, 2017.

Streamline Builders | Date Uploaded: July 15, 2021

| Date Created: | Construction, Interior Design

| Multifamily

| CALIFORNIA

The Pointe - Pool Deck & Sun Lounge Renovation by Streamline Builders.. Nov, 2017

Streamline Builders | Date Uploaded: July 15, 2021

| Date Created: | Construction, Landscaping

| Multifamily

| CALIFORNIA

The Pointe at Warner Center - BEFORE..The Pointe At Warner Center Apts.

6150 Canoga Avenue

Los Angeles, CA 91650

This is a video of a pool deck restoration where we demoed the deck down to the podium, re-waterproofed it, added electrical and drainage, infilled structural foam and poured a new deck with a coating. From Oct 27, 2017.

Streamline Builders | Date Uploaded: July 15, 2021

| Date Created: | Construction

| Multifamily

| CALIFORNIA

#CRELadiesGroup

"TURNING UP THE POWER FOR A NEW DOWNTOWN"

Guest Speaker: Christine Firstenberg

Leeds Real Estate Group | Date Uploaded: July 12, 2021

| Date Created: | Commercial Properties for Lease, Brokerage, Development/Planning/Entitlements, Events / Webinars

| Retail, Restaurant

| CALIFORNIA

Highlights:

- New construction office building coming to the Central Business District

- Fall 2022 delivery

- 3,396 SF available, may be divided into 1,622 SF and 1,774 SF

- Situated underneath office space

- Easy access to public transit

2222 Market St, Philadelphia, PA 19103

More Info: https://tristatecr.com/inventory-PA?p...

Tri State Commercial Realty | Date Uploaded: July 12, 2021

| Date Created: | Commercial Properties for Lease

| Retail, Restaurant

| PENNSYLVANIA

Highlights:

- 2 floors with 35,000 SF each, will demise

- Industrial/flex space in South Philadelphia perfect for retail use like flooring, furniture, fabric, etc.

- Includes a billboard facing I-95 available to the tenant

- Great access and visibility from I-95

- Loading docks and off-street parking

22 Wolf St, Philadelphia, PA 19148

More Info: https://tristatecr.com/inventory-PA?p...

Tri State Commercial Realty | Date Uploaded: July 12, 2021

| Date Created: | Commercial Properties for Lease

| Industrial, Retail

| PENNSYLVANIA

Highlights:

-Superb visibility and signage opportunities

-The entire building is to be renovated

-Liquor License is included in the base rental rate

-Ground level is 1,780 SF and the basement is 3,000 SF

-Bi-Level space

71 N 2nd St, Philadelphia, PA 19106

More Info: https://tristatecr.com/inventory-PA?p...

https://my.matterport.com/show/?m=5EY...

Tri State Commercial Realty | Date Uploaded: July 12, 2021

| Date Created: | Commercial Properties for Lease

| Retail, Restaurant

| PENNSYLVANIA

Highlights:

-Prime location on the corner of Chestnut St and High St

-3rd floor office available for lease

-Share a building with Univest Bank

-Downtown West Chester

200 N High St, West Chester, PA 19380

More Info: https://tristatecr.com/inventory-PA?p...

Tri State Commercial Realty | Date Uploaded: July 12, 2021

| Date Created: | Commercial Properties for Lease

| Office

| PENNSYLVANIA

- Quickly accessible via major roadways including Route 202, Route 322 and Paoli Pike

- On-site parking and car charging stations

- Near downtown West Chester

- Flexible lease terms available

- 200-4000SF

770-790 E Market St, West Chester, PA 191382

https://tristatecr.com/pennsylvania-c...

Tri State Commercial Realty | Date Uploaded: July 12, 2021

| Date Created: | Commercial Properties for Lease

| Office

| PENNSYLVANIA

SVN Auction Services announces the UDOT Government-Owned Land Auction for the the Utah's Department of Transportation.

Managing Director, David Gilmore CCIM with SVN Auction Services is featured during the LIVE SVN Call hosted by the SVN International Corp.

The video has been edited to include more details of the two featured properties located in West Valley City and Hurricane in Utah.

With over 14 properties to bid on, the July 13th - July 20th bidding event will be a great opportunity for commercial real estate developers and residential investors looking to add to their portfolios.

For more information, visit https://www.udotauctions.utah.gov/auc...

Or contact David Gilmore or Louis Fisher with SVN Alta Commercial, who are both working in cooperation with each other to organize the auction.

#landauction #landopportunity #commercialdevelopment #residential #investmentopportunity #landforsale #svn

Ruby Red Media | Date Uploaded: July 08, 2021

| Date Created: | Commercial Properties for Sale, Brokerage, Marketing/PR

| Industrial, Land, Residential, Mixed-Use: Industrial / Office

| UTAH

Commercial Real Estate is one of the largest industries in the world. Meet the very Women in CRE who are trailblazing the industry in every capacity.

Get connected to some of the most **AMAZING** Women in CRE across the world on the NEW Facebook group, Women in Commercial Real Estate. Be part of this amazing network of intelligent women (men are welcome to join too) that benefit from the group. https://www.facebook.com/groups/20082...

BENEFITS:

✅ Post your Listings (City, State)

✅ Post your Tenant & Purchase Requirements

✅ Request Support and/or Share Best Practices

✅ Connect with other advisors - Co-Broker Opportunities

✅ Referral Opportunities / Build your pipeline

✅ Join in the CCIM, SIOR or CREW discussions

✅ Get Free Marketing Tips

#CREmarketing #WomeninCRE #marketing #networking #CommercialRealEstate

Ruby Red Media | Date Uploaded: July 08, 2021

| Date Created: | Brokerage, News, ESG (Environmental, Social and Governance), Marketing/PR

| ALL

| ALL

⭐️ Real Talk, Real Business, Real People - Inside the studio with America's commercial real estate tax expert, Jamie Pope.

If you own commercial property or represent your clients in the CRE industry, then take some time to listen to some expert advice and information that helps commercial real estate industry professionals "Sell More Commercial Real Estate"

From CARES Act and PPP to the 1031 Exchange and Opportunity Zones, you will not want to miss this episode, as it can help you save your clients money that helps you sell the property.

#jamiepope #jpopetax #CaresAct #JPopetaxconsultancy #commercialpropertytaxes

Ruby Red Media | Date Uploaded: July 08, 2021

| Date Created: | Brokerage, Tax Services/Accounting

| ALL

| ALL

Inside the studio with 🔷Andrea Davis, CCIM🔷 and author of SimpLEASEity, a book designed to help every commercial real estate advisor learn about commercial real estate leasing. Her specialty in office, industrial and flex.

Andrea also breaks down some insights regarding how her tenant representation & how she brings a full comprehensive service, saving her clients 10-20% in lease negotiations. She is located in Scottsdale, Arizona and can be reached directly here: ⬇️⬇️

https://andreadavis.co/ | 480-225-0838 | andrea@andreadaviscre.com

Watch a quick video here: https://youtu.be/j8uTBsDL_Vo

#marketing #commercialrealestate #andreadavisCCIM #podcast

Ruby Red Media | Date Uploaded: July 08, 2021

| Date Created: | Commercial Properties for Lease, Commercial Properties for Sale, Brokerage, Marketing/PR

| Office

| ARIZONA

❇️ Join us to watch this amazing podcast show with Ingrid Tucker, landlord and tenant representative. Update: Ingrid Tucker is now working at Whitestone REIT in Scottsdale AZ.

Inside this episode you will learn more about Ingrid, her recent achievements, her move into Commercial Real Estate and more.

#podcast #melissaswader #realtalk #business #commercialrealestate

Ruby Red Media | Date Uploaded: July 08, 2021

| Date Created: | Brokerage, Marketing/PR

| Retail

| ARIZONA

Inside the studio with 2018 Producer of the Year, 2018 IREM/CCIM Broker Panelist and Retail Interface Panelist, and the 2020 Retail Broker of the Year with AZ Business Leaders magazine, Rommie Mojahed. We know that Commercial Real Estate in thriving in the State of Arizona and I sat down with Rommie to discuss the CRE industry, market trends, and what's next in CRE with one of the top brokers in the state. If you have any questions for Rommie Mojahed following this show, he can be reached at rommie.mojahed@svn.com

Ruby Red Media | Date Uploaded: July 08, 2021

| Date Created: | Brokerage, Marketing/PR

| Industrial, Land, Retail

| ARIZONA